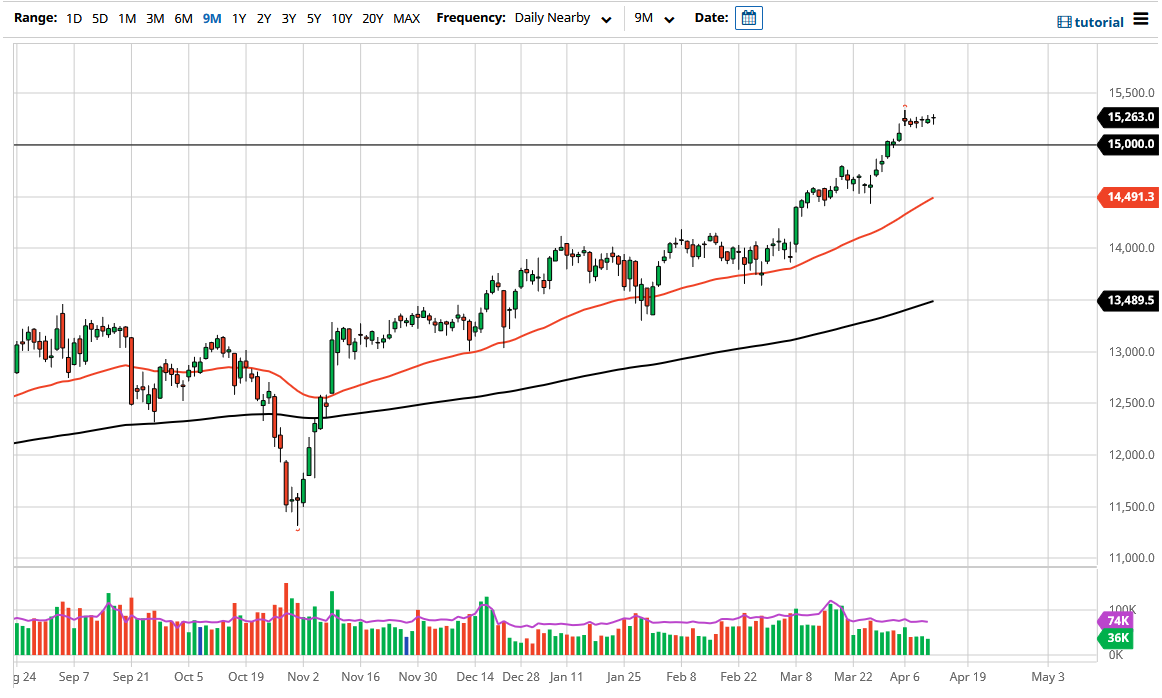

The DAX has done very little during the trading session on Tuesday as we continue to hover around the 15,250 level. This is a market that continues to be very quiet, as we have no idea what to do with ourselves currently. It is starting to show signs of “working off the froth” from the previous uptrend, which may have gotten a little bit ahead of itself. Nonetheless, I see plenty of support underneath that I want to be involved with, not the least of which would be the level that sits just below current trading. Beyond that, we also have the 15,000 level, which is right in the same neighborhood, so I think at this point it is probably best to look at that as a massive support level.

To the upside, I look at the 15,500 level as the most likely of targets, and something that the market will be aiming for given enough time. The DAX is the “blue-chip stock index” of the European Union in general, and therefore it is one of the first places that money goes to get put to work. Ultimately, I think this is a market that is worth paying attention to, not only due to the fact that it is Germany, but the fact that it gives you an idea as to what people think about global trade and demand in general for overall industrial goods.

If we were to break down below the 15,000 level, we probably have a move to the 14,750 level just waiting to happen, and after that we could even go down to the 50-day EMA which is reaching towards the 14,500 level. The 50-day EMA should continue to offer plenty of support, and I think that people will look at it as such. With that in mind, I am looking for dips as buying opportunities that I can take advantage of, as we have been in such a strong uptrend. With central bank manipulation, you cannot short stock indices, regardless of the country. Central banks around the world are all pulling from the same playbook, flooding the markets with cheap money. The fact that we have gone sideways for six or seven days in a row is actually a good thing, not a bad thing.