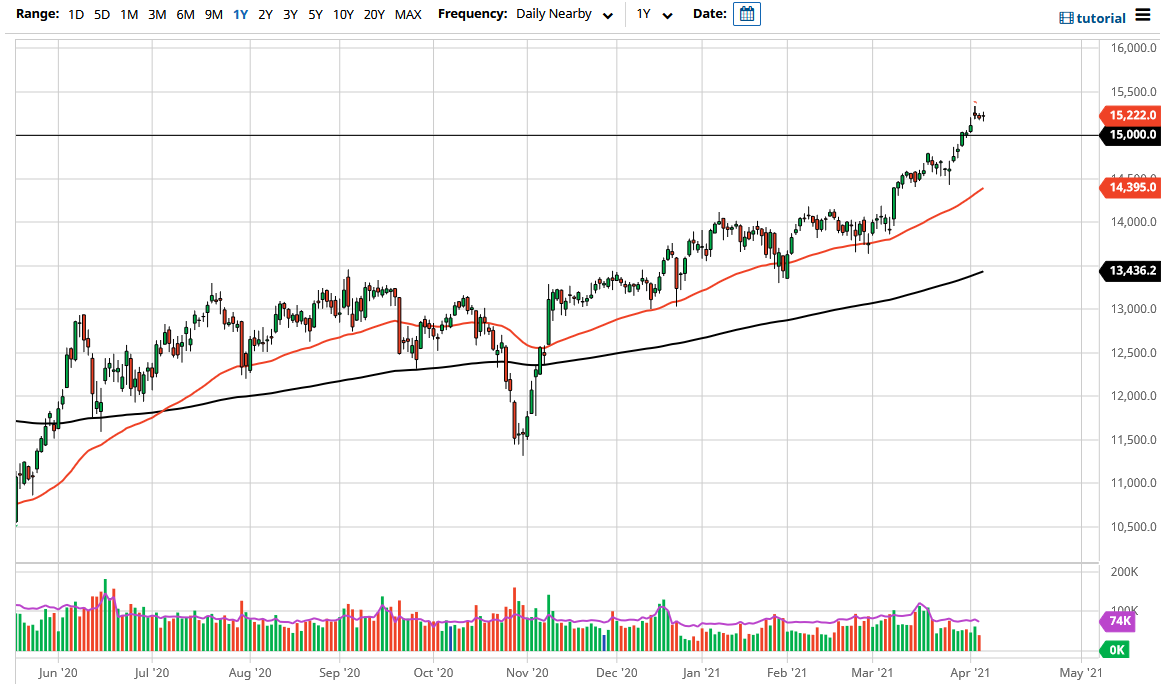

The German index did very little during the trading session on Thursday as we continue to see lackluster performance. That being said though, we are at an elevated level, and have cleared the 15,000 level rather handily. That suggests to me that we should continue to see opportunities to get long given enough time, and therefore I think that pullbacks will continue to be buying opportunities. The 15,000 level underneath should be significant support, and therefore it be very interested in some type of supportive daily candlesticks near that area after a short-term pullback.

That being said, even if we do not get that I clearly would not be a seller regardless. If we can break above the highs from a couple of sessions ago, that might be good enough as well, as we will continue to see the market try to sort itself out and perhaps work off some of the froth that an overextended market tends to attract. The market has gone straight up in the air until the last couple of days, so quite frankly I think this is the type of price action that you would expect to see. In a healthy uptrend, the market will simply hesitate and perhaps digest some of the gains before we go higher. I would like to see a bit of a pullback, but if we do not get it, I am not overly concerned either.

It is not until we break down below the 14,500 level that I would be concerned, where the 50 day EMA currently finds itself. Even then, I think we could probably find significant support near the 14,000 handle. This is a market that will continue to get a huge benefit from the idea that the global economy is trying to reopen, and of course there are huge industrial corporations in Germany that make up a huge portion of this index. It is essentially the “Dow Jones Industrial Average” of the European Union.

Over the longer term, I anticipate that this market will go looking towards the 15,500 level, followed by the 16,000 level given enough time. This is a “buy on the dips” and “long only” type of situation as far as I can see. Unless something changes rather drastically, I do not see an opportunity to trade in the other direction, at least not safely.