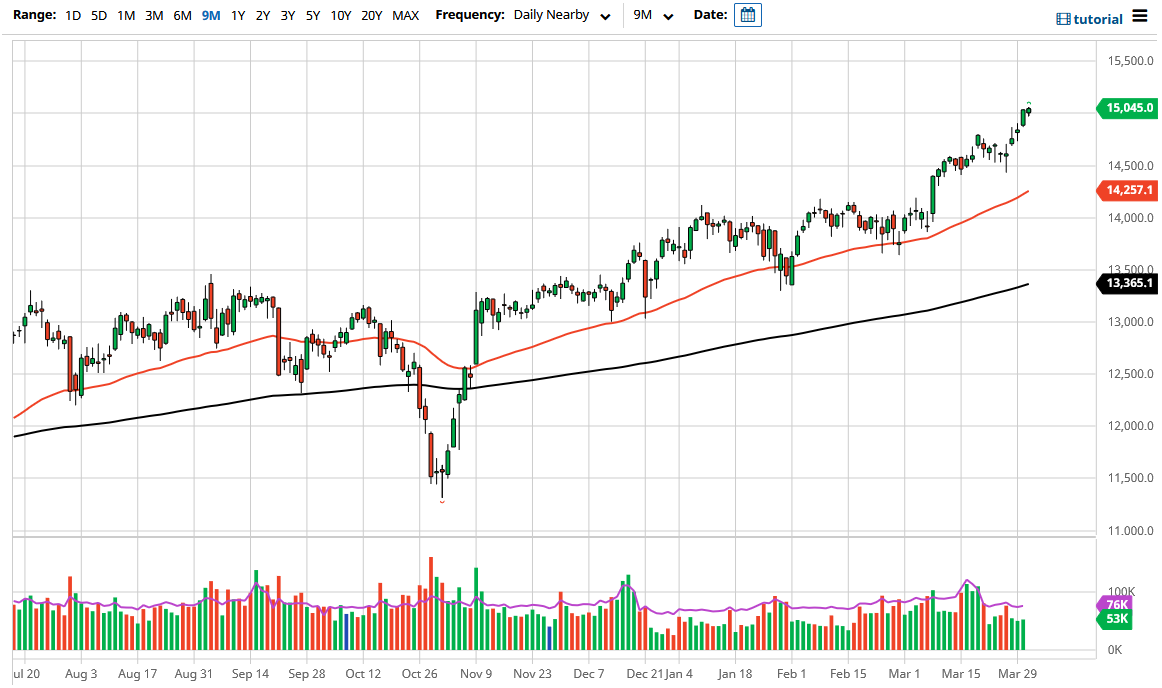

The DAX has rallied again during the trading session on Wednesday, as we are now above the 15,000 level. The DAX of course is a significant player when it comes to European indices, as it is the “blue-chip stock index for the continent.” The DAX of course has a lot of exporters and it, and that suggests that people are still counting on the global recovery to push things higher in this index. After all, Germany produces a lot of the major industrial components that the world will need in order to reinflate economies.

To the downside, I see significant support all the way down to the 14,500 level, so I believe that short-term pullbacks will be thought of as buying opportunities. As long as we can stay above the 14,500 level, we are still very bullish, especially as the 50 day EMA is racing towards that region. The 50 day EMA has been very substantial when it comes to the upside, as it has offered dynamic support more than once. With that in mind, I think that a lot of technical traders will simply be looking at that as a potential entry.

To the upside, I do not have any real target yet, but it does make sense that every 500 points or so, we would see a significant amount of resistance. This is just due to the “round number aspect” of trading, as it tends to attract buyers and sellers. Because of this, I think that it offers a little bit of a floor in the market for the short term. That being said, we are about 700 points above there so we have a long way to go before I would even be worried about the uptrend being threatened. We have had a couple of very strong sessions, so a short-term pullback could be a real possibility. Nonetheless, I do think that means that you should be concerned, rather that you should be looking for opportunities on bounces to take advantage of a market that has been so bullish. I would also be a buyer of any break above the top of the range for the trading session on Wednesday as well, and I think money would flow into the market at that point in time. It is a strong uptrend, there is no need in fighting it.