Speculators who have not been paying attention to ETH/USD may want to change their perspectives immediately. ETH/USD has again attained record high values and continues to make technical resistance levels look like mere suggestions. Higher values are being achieved on a nearly constant basis as speculative frenzy grows and the broad cryptocurrency market enjoys its time in the sunshine.

Yesterday’s move higher brings ETH/USD within sight of the 2500.00 mark and while that may sound like a rather interesting notion for psychological resistance, it may prove to be just another road sign Ethereum drives through and waves goodbye to as it moves higher. Yes, ladies and gentlemen reversals lower can happen. Speculative assets do have days when they actually lose value, actually this is done on a rather consistent basis within most assets, but for the moment ETH/USD has been proving rather unlike other wagers within the financial market.

It is not a joke to say the juncture of 3000.00 may prove to be legitimate resistance. While that value is seemingly a world away from the current price of ETH/USD, it should be remembered Ethereum was trading near a high of 2000.00 on the 19th of February. The ability of ETH/USD to foster buying momentum has been exuberant and volatility has been a constant. On the 25th of March ETH/USD was trading near 1500.00, this is highlighted to show the ability and speed Ethereum has at its disposal in order to gain and lose money.

The broad cryptocurrency market has seen gains across a large spectrum the past week and this has occurred as speculative fuel has been poured into the sector as COIN via Coinbase Global has seen its stock issue enter the consciousness of the investment world. Technical charts are important still, but fundamental sentiment has turned quite bullish too in the short term. The combination of strong technical and fundamental momentum has helped ETH/USD achieve its current pace.

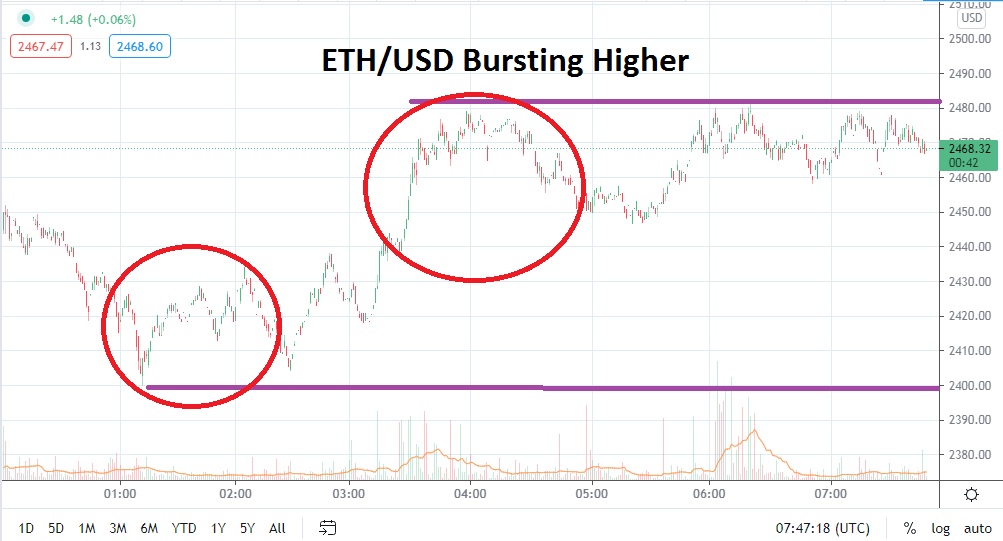

Short term targets for traders looking to buy ETH/USD may be the junctures of 2480.00 to 2500.00. Speculators are encouraged to keep their feet on the ground and not dream too big. They are also reminded that it only takes a moment within the cryptocurrency world for sentiment to change and volatility to strike in a way that can decimate speculative wagers. Traders should use stop losses and take profit tactics with a well thought out plan. ETH/USD is enticing, but there are no guarantees its trend is a one way avenue.

Ethereum Short Term Outlook:

Current Resistance: 2482.00

Current Support: 2450.00

High Target: 2550.00

Low Target: 2417.00