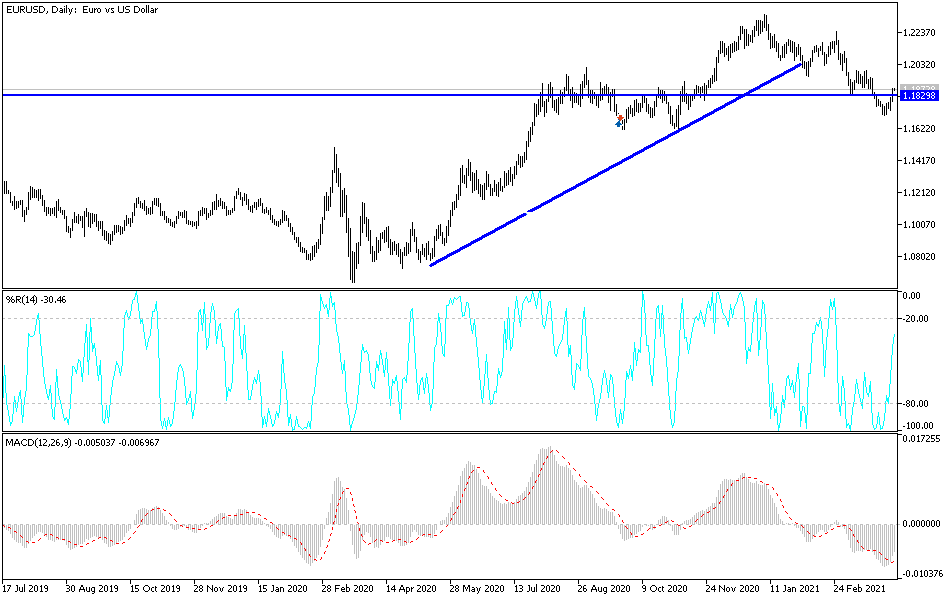

The euro has broken to the upside during the trading session on Tuesday to clear the 200-day EMA. This certainly looks as if it is a market that is trying to rally significantly, but at the end of the day it still has plenty of things to worry about just above. After all, we have the 1.19 level, and then the previous uptrend line that should come into play. After that, we could see a certain amount of noise coming in due to the 50-day EMA as well.

Although it certainly looks very bullish in the short term, I still do not necessarily feel that comfortable simply jumping into this market right away, although for you super short-term traders, you may have the possibility to take advantage of this. As for myself, I will be paying close attention to the confluence of the uptrend line, the 1.19 handle, and the 50-day EMA for signs of weakness that I can fade. I would also keep an eye on the 10-year yield, because if it starts to rise again, that might be reason enough to get involved as well.

The size of the candlestick is relatively strong, and the fact that we are closing at the top of it does bode well also. However, you can see that we have clearly been grinding lower for a while, so the question now is whether or not we can continue to rally. Even if we do, I cannot imagine that it is going to simply slice through all of those resistance areas above. If it does, then I think at that point in time you would probably be looking at the possibility of a return to bullish pressure.

It is worth noting that the weekly candlestick was a hammer from last week, but at the end of the day it only suggests that perhaps we had gotten a bit oversold, and there may have been a bit of position scoring going into the weekend as we had a long holiday. Because of this, I would be very cautious about jumping in wholeheartedly, but clearly, we are ready to make a bigger move sooner rather than later. A little bit of patience should have this market shyness exactly where it wants to go for a bigger move.