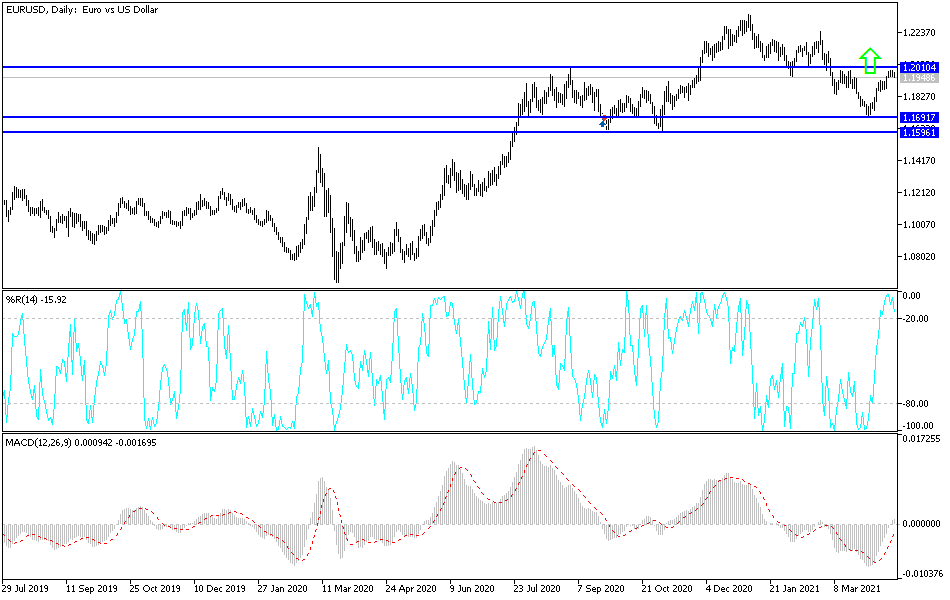

The euro fluctuated during the course of the trading session on Friday, as we continue to see the 1.20 level as a major barrier. This is an area that has been massive resistance previously, so it certainly makes sense that it would continue to be so going forward. With this being the case, I think what we are looking at is a scenario in which the market is trying to overcome major selling pressure. That being said, we have a bit of a “binary setup” going forward, as we are either above the 1.20 handle or we are not.

If we were to get a daily close above the 1.20 handle, then I think it opens up the possibility of a move towards the 1.21 level, followed by the 1.22 level. To the downside, if we were to break down below the 50-day EMA, it is likely that we would go looking towards the 1.19 handle, possibly even lower than that, kicking off a move down towards the 200-day EMA.

Keep in mind that the marketplace will continue to be very noisy in this general vicinity, but more likely than not we will see some type of impulsive candlestick that we can take advantage of, and most certainly should. I think what we are ready to see is a decision on a longer-term move. Because of this, I think that a nice setup is coming, and I look at a breakdown below that 50-day EMA as a selling opportunity, but a daily close above that 1.20 level as a buying opportunity. I really think that at this point we are about to see a big move, because it has been so tight for the last couple of weeks.

Yields in America will be a big reason as to why we go higher or lower, so that is most certainly worth paying attention to. I think what we are seeing is inertia being built up in order to move this market quite drastically. This is going to be a nice opportunity given enough time, but you should let the market do the work for you, telling you when it is time to get involved to the upside over the downside.