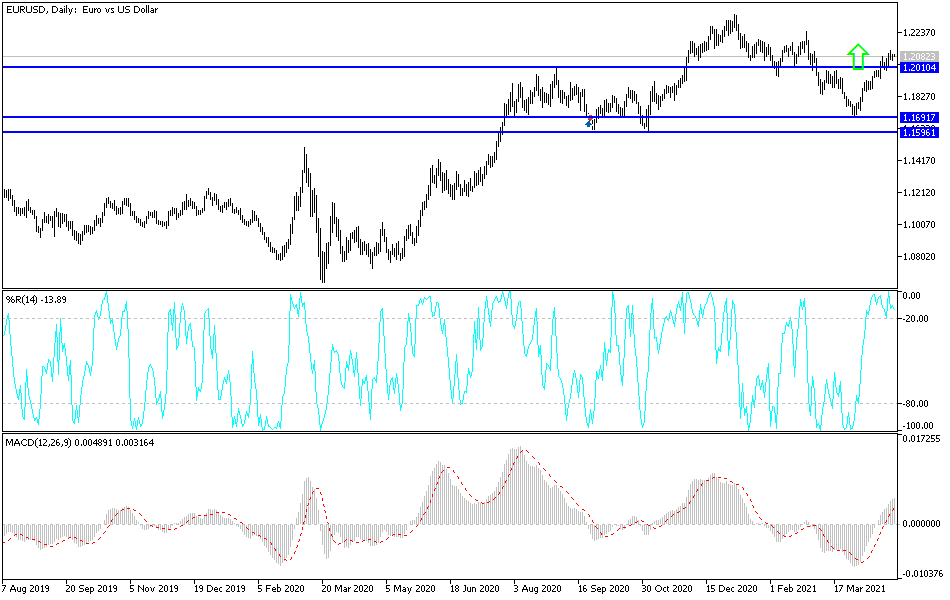

The euro has initially fallen during the trading session on Tuesday but found buyers later in the day to suggest that perhaps we are going to try to take out this minor downtrend line that sits just above. If we can break above the 1.21 handle, that could be our sign that we are going to go much higher. At that point, I would anticipate a move to the 1.22 handle, which is an area where we had seen some selling pressure previously. With that, I think that the market will eventually go looking towards the level, and eventually break above there to go looking towards 1.23 handle if we clear this downtrend line.

Underneath, the 1.20 handle is an area that you have to be paying close attention to, as we did bounce from that level quite heartily earlier in the week. Because of this, I think that the market will continue to hear a lot of noise in general, but the fact that we have continued to push to the upside suggests to me that it is only a matter of time before the buyers step up. That being said, I do not think that it is going to be an easy move to the upside; but then again, it never is when you are trading the euro, as it is very choppy.

If we do break down from here, it is not until we break down below the 50-day EMA that I am willing to start selling now, because it looks as if the euro is starting to price in the idea of a recovery from the coronavirus, and it is likely that traders are going to continue to try to push to the upside. Furthermore, the market is likely to see a lot of noisy behavior, so you should also keep that in mind. Ultimately, I do think that we are looking at a scenario in which the market needs to make a bigger decision, but right now it appears to me that we are simply trying to build up the necessary momentum to finally clear the hurdle. If we did break down below the 50-day EMA, though, then we could see a lot of negativity in the euro. I think this is going to be messy to say the least.