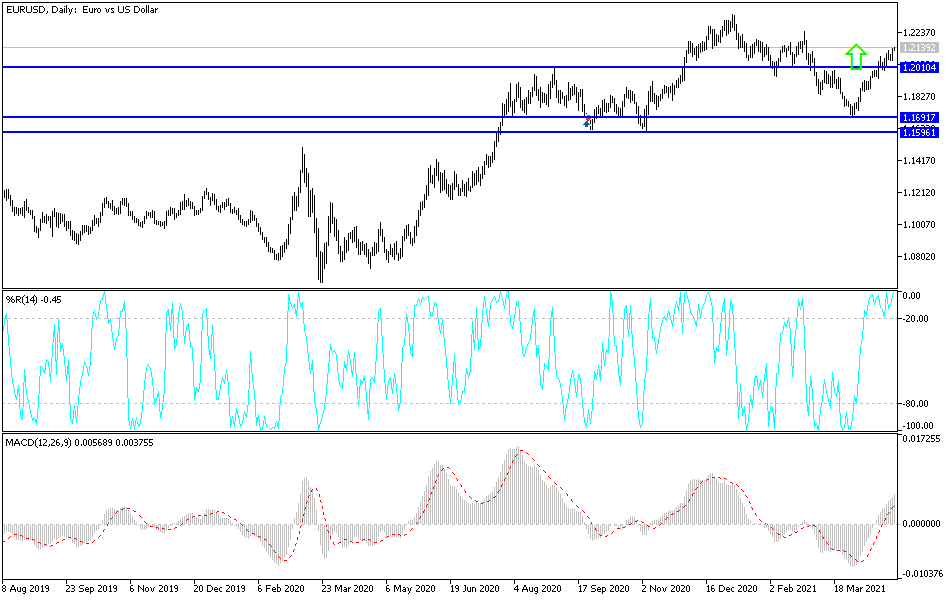

The euro shot above the uptrend line during the trading session on Wednesday as we awaited the Federal Reserve FOMC statement and press conference. At this point, you can see that the market is clearly trying to take off to the upside but has also given back quite a bit of the gains from the highs of the day. There is a downtrend line that we have been pressuring over the last couple of days, and now I think at this point there is a straightforward entry if we can break above the top of the range of the session. Breaking above there would confirm the trendline breakout and then open up a move to the 1.22 handle.

On the other hand, we have significant support at the 1.2057 level, and if we break down below the lows of the last couple of days, then I think it is likely that we will drop down towards the 50-day EMA, perhaps even down to the 200-day EMA. This is a market that is likely to see a lot of choppy behavior, but given enough time, we should eventually take off if the Federal Reserve continues to look as dovish as it appears.

If we can break above the 1.22 handle, then it opens up the possibility of a move to the 1.23 level, but at the end of the day, I think both of these currencies probably have their own issues. This is a horrible pair to trade a lot of times, because it is nothing but choppiness most of the time. We are in the midst of an uptrend, and it certainly looks as if the US dollar is going to struggle due to the idea of extreme amounts of liquidity been forced into the market, but at the same time we need to pay close attention to interest rates in the United States. If they get out of hand again, taking off to the upside, that could result in US dollar demand, as it would continue to offer better and more attractive returns than you have against multiple other currencies. Unless that happens, I do believe that eventually we will try to grind to the upside, but the upside is somewhat limited.