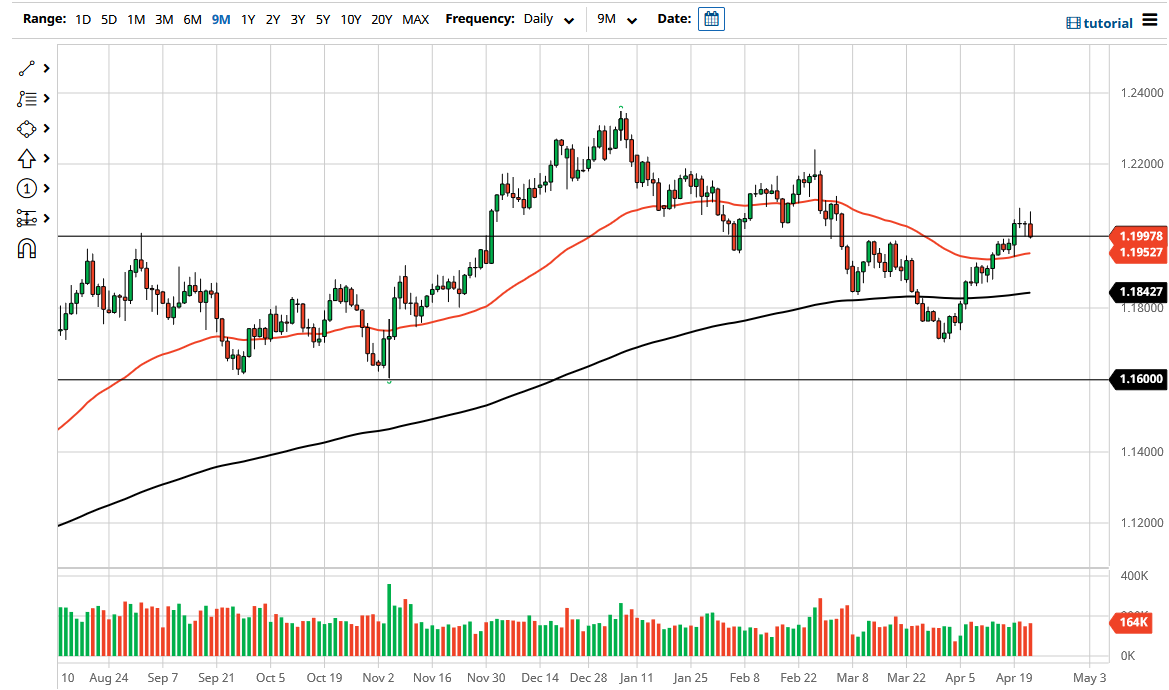

The Euro initially tried to rally during the trading session, perhaps anticipating the ECB meeting. However, we obviously did not get what the market needed to see during that, as we initially spiked towards the 1.21 level only to give it back up. We have now at the end of the day started to test the 1.20 level, an area that continues to be important. Furthermore, the market is likely to see a lot of noise between here and the 50 day EMA, so it is possible that we could see some type of turnaround.

That being said, if we break down below the 50 day EMA, I think that would be extraordinarily negative, perhaps opening up a much bigger move to the downside and whether or not we are going to go down to the 200 day EMA. The 200 day EMA of course is a large technical indicator that a lot of people would be paying close attention to, so breaking down below there could open up the floor in the market. It is worth noting that the US dollar has been stubbornly resilient, and whether or not the US dollar gives up strength is essentially what is going to propel the Euro higher or lower.

The press conference after the ECB announcement was a bit “wishy-washy”, so I think the market was a bit disappointed by the idea of whether or not the ECB was ready to take bold action. The Bank of Canada has started talking about tapering bond purchases, and while Christine Largarde was asked whether or not the ECB code, she said that it was premature to have that discussion. That being said, the market is likely to continue to see the 1.20 level as important, so if we break hard in one direction or the other, that will certainly bring in a lot of money. The US bond markets have been all over the place during the trading session, so that has given traders headaches for short-term positions anyway. To the upside, if we were to break above the high from both Tuesday and Thursday, then it opens up the possibility of a move towards the 1.22 handle above which has seen a massive amount of selling in the past. The market looks like it is ready to chop up trading accounts in the short term.