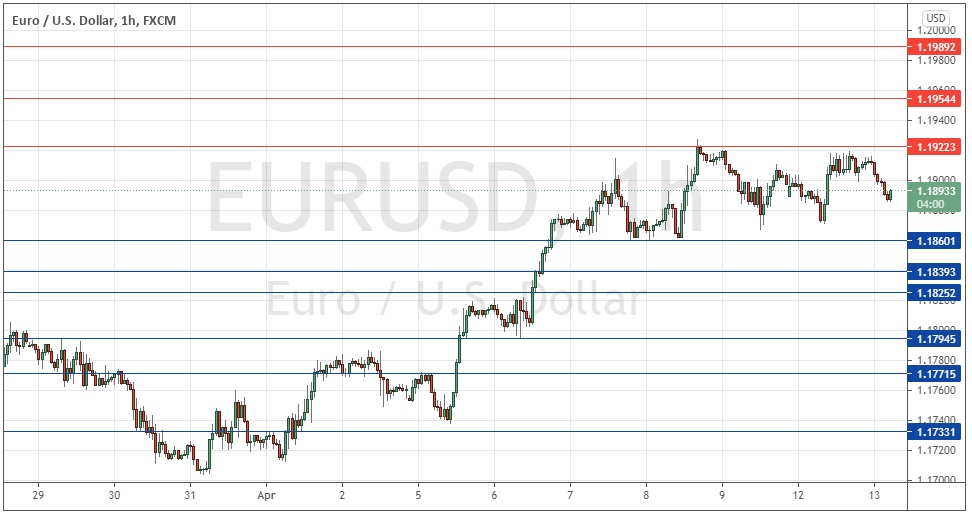

Last Thursday’s EUR/USD signals produced a profitable long trade from the bullish bounce off the support level identified at 1.1863.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered prior to 5pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1922, 1.1954, or 1.1989.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1860, 1.1839, or 1.1825.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that the key technical developments to watch for were whether the resistance at 1.1880 continued to hold, or if the price broke below 1.1863, but I was more excited about a break above 1.1880 as the line of least resistance still looked likely to be upwards.

This was a good call as the price rose over the day from the support level at 1.1863, after breaking above 1.1880, so there was an opportunity to profit here on the long side.

We have seen the Euro gain a lot of ground over the past week or two, but although there is still buying from support and residual strength in the Euro, the move seems to have run out of steam due to the price reaching close to an area of important long-term resistance at and just below 1.2000. It may well take the price longer to break through this area so I can see this bullish consolidation between 1.1860 and 1.1922 persisting for a while unless we get a surprise later today from the U.S. CPI data.

I am ready to take a long trade from a bullish bounce at 1.1880. If the price can get established above 1.1922 that will be a bullish sign, but any move will probably not have much further than that to run over the near term. Regarding either the USD, there will be a release of CPI (inflation) data at 1:30pm London time. There is nothing of high importance scheduled today concerning the EUR.

Regarding either the USD, there will be a release of CPI (inflation) data at 1:30pm London time. There is nothing of high importance scheduled today concerning the EUR.