Bullish View

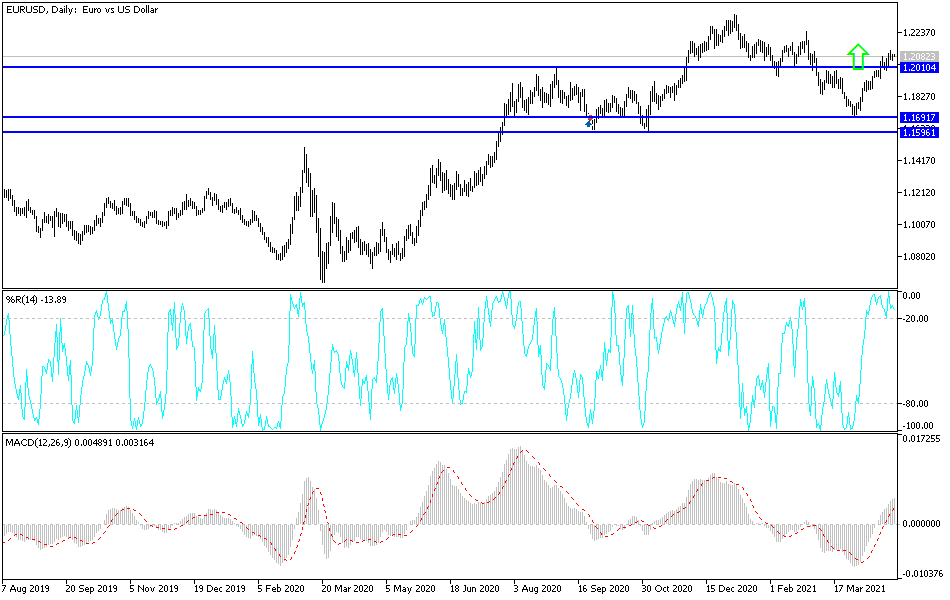

- Set a buy stop at 1.2116 (this week’s high).

- Add a take-profit at 1.2200 and stop-loss at 1.2100.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.2050 and a take-profit at 1.1970 (50% Fibonacci).

- Add a stop-loss at 1.2110.

The EUR/USD is in a tight range as the market focuses on the upcoming Federal Reserve interest rate decision. It is trading at 1.2078, where it has been for the past few sessions.

Fed Decision to Be the Main Catalyst

There will be no economic numbers from the Eurozone today. Therefore, investors will be focusing on the Federal Reserve, which will conclude its two-day meeting during the American session.

The decision comes at a time when some central banks have started to tighten their policies. In the emerging market, countries like Turkey, Brazil and Russia have already seen some rate increases to tame the runaway inflation. In some developed countries like Canada and Norway, the central banks have started hinting at potential tightening.

The Fed decision comes at a time when the US economy is firing on all cylinders. On Tuesday, companies like Alphabet and Microsoft published strong results, with the former’s revenue surging to more than $55 billion. According to FactSet, more than 70% of all companies that have reported their earnings beating the estimates. As a result, the major indices are at their highest level on record.

Economic data has also been strong. This month, data showed that the headline inflation surged to 2.6% while retail sales surged by almost 10%. And yesterday, numbers by the Conference Board revealed that consumer confidence rose from 109 to 121.7 in April.

Therefore, this Fed meeting will be important because of the strength of the American economy. While the Fed will leave interest rates unchanged, some analysts are torn about the asset purchases. Some argue that the Fed will continue making asset purchases, while some believe it will start warning about tapering. A hawkish Fed will be bearish for the EUR/USD and vice-versa.

EUR/USD Forecast

The EUR/USD is holding steady ahead of the FOMC decision. On the four-hour chart, it is between the 23.6% and 38.2% Fibonacci retracement levels. The pair’s upward trend is being supported by the 28-day and 56-day exponential moving averages while the MACD seems to be forming a bearish divergence pattern.

The pair will likely resume the upward trend as bulls target the highest level this week of 1.2115. Nonetheless, a move below the dynamic support of the two moving averages will invalidate the bullish thesis because it will be a sign that there are still sellers left in the market.