Bullish View

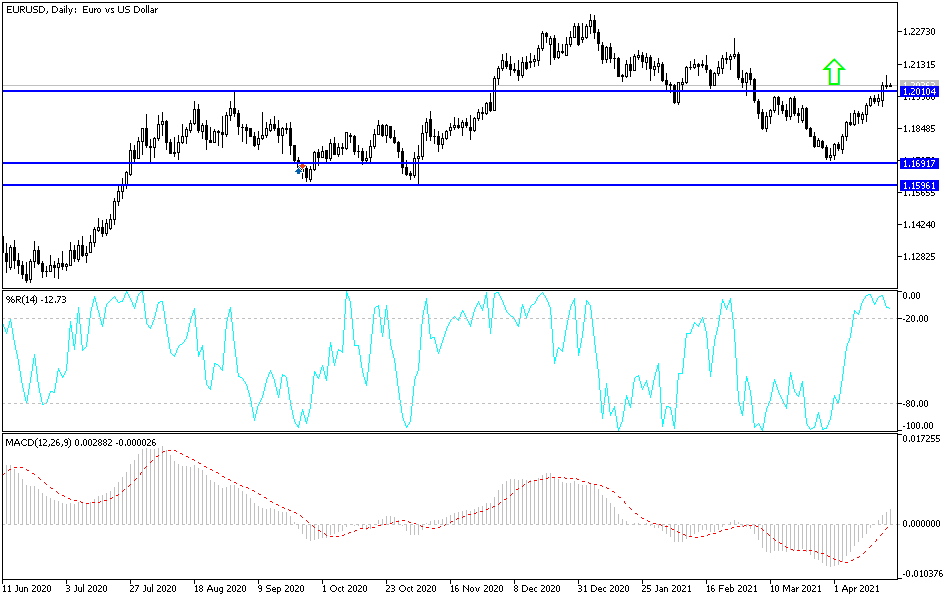

Set a buy stop at 1.2050 and a take-profit at 1.2115 (23.6% retracement).

Add a stop-loss at 1.2000 (lower side of the ascending channel).

Timeline: 1 - 2 days.

Bearish View

Set a sell-stop at 1.2023 (yesterday low) and a take-profit at 1.1972 (50% retracement).

Add a stop-loss at 1.2075.

The EUR/USD is in a tight range as the European Central Bank (ECB) starts its monetary policy meeting and as US bond yields rise. It is trading at 1.2030, which is slightly below this week’s high of 1.2080.

ECB Interest Rate Decision Ahead

The biggest focus on the EUR/USD pair this week is the ECB interest rate decision that will happen on Thursday. The decision comes at a time when European countries are ramping their vaccination drive after lagging behind their peers like the United States.

Economists expect that the ECB will leave the interest rate unchanged during this meeting. It will also continue with its bond-buying program in a bid to continue supporting the economy. Also, it is expected to pledge to continue its monetary policy until inflation rises to above 2.0% and the unemployment rate falls.

Nonetheless, analysts have started to predict that the bank will start slowing its asset purchases by July and signal that it will end it in March next year. Such a move will be a sign of confidence that the European economy is on track to recover faster than expected.

The EUR/USD is also in a holding pattern as traders eye the US bond market. The benchmark 10-year Treasury yield has risen by 0.50% to 1.56% while the 30-year yield has risen by 0.35% to 2.26%. The 2-year yield, on the other hand, has declined by more than 2% to 0.14%.

At the same time, the VIX Index, which is a measure of volatility, has risen as the market questions the new surge in coronavirus cases globally. This, and the fear of slow corporate earnings growth, has led to a sharp decline of US stocks. The Dow Jones fell by more than 256 points while the S&P 500 declined by 30 points.

EUR/USD Technical Forecast

The EUR/USD pair is trading at 1.2030, which is slightly below this week’s high of 1.2080. On the four-hour chart, the pair has moved below the 38.2% Fibonacci retracement level. Also, it has moved below the upper side of the ascending channel that is shown in black. The price uptrend is also being supported by the 25-day and 15-day exponential moving average (EMA). Therefore, the upward trend will remain so long as the price is above these two averages. At the same time, we should not rule out another retest of the lower side of the channel at 1.2000.