Positive movement in the EUR/USD during last week’s trading resulted in gains that pushed the pair to the 1.1927 resistance level, but it closed the week stable around the 1.1900 level. The pair now awaits stronger incentives to complete the correction to the upside, as the psychological resistance of 1.2000 remains the most important for the bulls at present. However, the bullish momentum of the currency pair lacks momentum. Europe remains a hotspot for the spread of the virus. Global vaccination efforts, especially European ones, are facing obstacles to completely eradicate the epidemic.

The global increase in coronavirus cases and deaths includes even Thailand, which has survived the epidemic much better than many countries but is now struggling to contain COVID-19. The only exception to the worsening situation are countries with advanced vaccination programs, most notably Britain. The United States, the world leader in vaccinations, is seeing a slight rise in new cases, and the White House announced on Friday that it would send federal aid to Michigan to control the state's worst outbreak.

For its part, the World Health Organization said that infection rates are rising in every global region, driven by new COVID variants and the exit of many countries from lockdowns very soon. In its weekly epidemiological update, the organization also said that more than 4 million cases of COVID-19 were reported in the past week. New deaths are up 11% compared to last week, with more than 71,000 deaths reported.

The growing number of infections, hospitalizations and deaths is extending to countries where vaccines are finally gaining momentum. This leaves darker outlooks in much of the world, where large-scale vaccination programs remain elusive.

The International Monetary Fund met market expectations, but growth this year has been different, and economists expect China’s growth in 2022 and 2023 to fall below 6%. As the rural-to-urban transformation progressed well and benefited greatly from the catch-up productivity gains, the growth drive slowed. With two exceptions (2010 and 2017), Chinese growth has been slowing every year since 2007. This year is an anomaly in the opposite direction of last year, but the average over the two years may be close to the new normal.

The International Monetary Fund also strengthened its forecast for economic growth in the US this year to 6.4%, compared to the 5.1% it forecast in January. It optimistically expects 4.4% growth in 2022, which is one-third faster than the average Fed officials forecast. The private sector economists appear to be closer to the IMF’s assessment of the next year than the Fed’s assessment. This may help explain why the market has fully priced in a rate hike more than a year ahead of the Fed's median forecast in March despite official data.

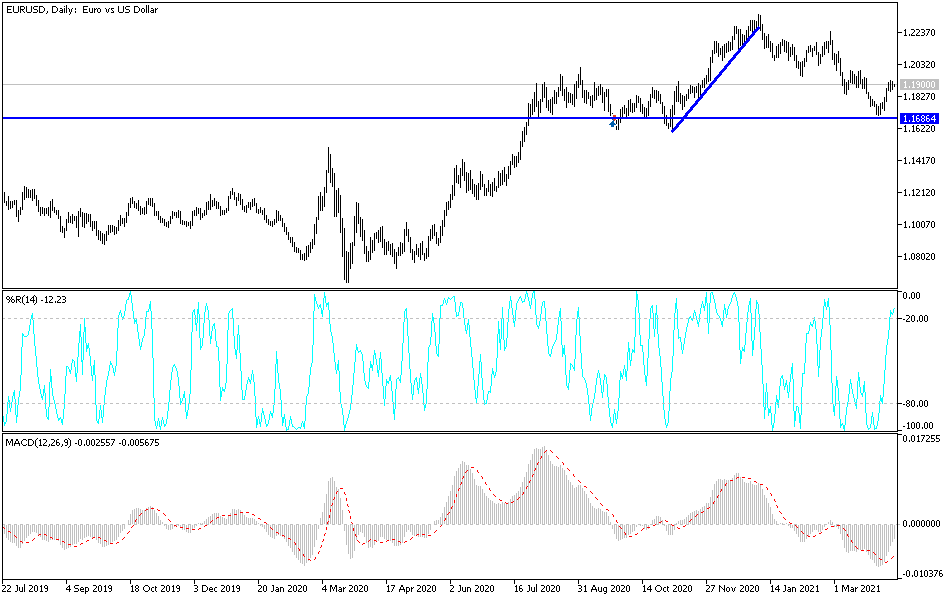

Technical analysis of the pair:

Despite the recent bounce attempts of the EUR/USD pair, the bulls' complete control of the performance is not final. First, it is necessary to stabilize above the psychological resistance of 1.2000, while observing the developments of infection rates, European vaccinations and stimulus efforts. I still see that any EUR gains will remain the selling focus. The closest resistance levels for the pair are currently 1.1975, 1.2020 and 1.2100. On the downside, the 1.1800 level remains the boundary between the return of the bears' dominance and the hope for a correction higher. All in all, the higher returns indicated that investors are increasingly expecting US inflation to rise sharply in the coming months and years as the economic recovery begins.

The currency pair is not anticipating any important and influencing US data today, and only retail sales numbers in the Eurozone will be released.