Risk appetite and a lull in the dollar's gains, despite the better-than-expected results of US inflation figures, contributed to more gains for the EUR/USD. The pair reached the 1.1956 resistance level, the highest for the currency pair in nearly a month, before stabilizing around the 1.1950 level as of this writing. The euro got some momentum from expectations that the bloc's economic recovery is nearing and that the stimulus plans scheduled by European leaders will ensure improved economic performance. This optimism, I see, is cautious, because Europe is still the epicenter of a strong outbreak of the epidemic, and vaccination efforts against the epidemic are being obstructed.

Spain is expected to receive 140 billion euros ($166 billion) - half of it direct payments and half in the form of loans - from the 750 billion euro ($908 billion) recovery plan adopted by European Union leaders last year at a time when the continent's economy suffered from closures, job losses and lower consumer spending.

Spanish Prime Minister Pedro Sanchez, the leader of the Spanish Socialists, has revealed his coalition government's plans to obtain the 70 billion ($83 billion) in direct aid it hopes to invest over the next three years. This is in line with the priorities of the European Union, as they place a strong emphasis on creating a greener economy, digitizing public businesses and administrations, and boosting productivity, all while fighting gender inequality and ensuring that densely populated rural areas in Spain are not neglected.

Accordingly, Sanchez stated: “This is Spain's biggest opportunity since its accession to the European Union, and that was 37 years ago. These opportunities only come twice in a generation, and Spain will not allow it."

The 27 European Union countries have until the end of the month to hand over coronavirus recovery plans to Brussels. Sanchez will present his plan for the first time to the Spanish Parliament on Wednesday, where opposition parties can argue for changes. Accordingly, Sanchez added that his government expects an annual growth in the country's GDP of 2% thanks to the fiscal stimulus for a country of 47 million whose economy shrank by -11% last year. The first goal of spending the recovery money is to make up for the hundreds of thousands of jobs lost in the epidemic, especially in Spain's big tourism industry.

Goldman Sachs expects that the EUR/USD pair will rise to the level of 1.27 during the next six months, well above the 1.20 level likely indicated by prices in the market for hedging futures, with the euro expected to rise to 1.28 in 12 months. Analysts at the bank are looking for the EUR/USD to rise to 1.21 over the next six months, which is no different from the latest forecast from ING. ING expects that the euro may rise from its first quarter lows, finally overcoming highs around 1.2350 seen in January of this year.

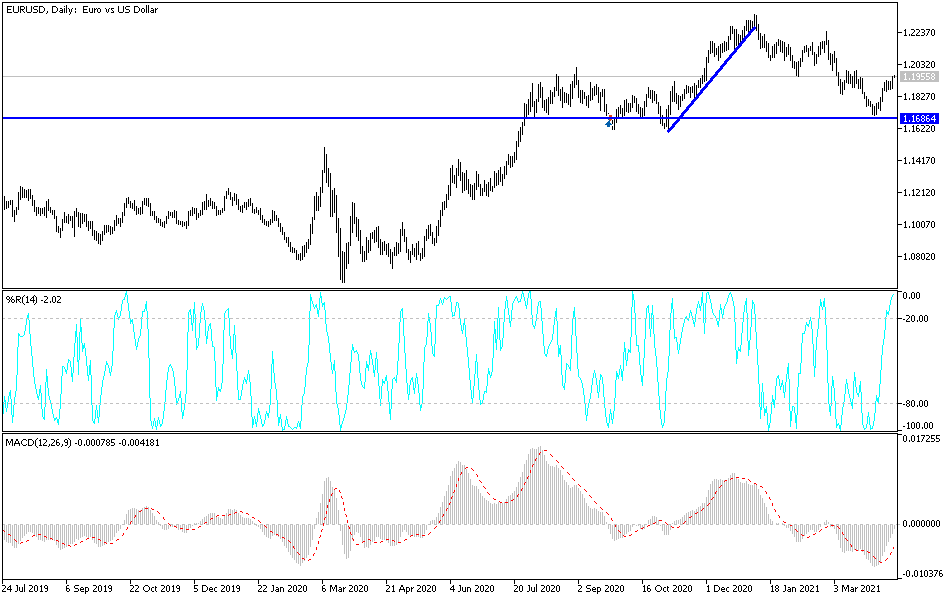

Technical analysis of the pair:

On the daily chart, and after the recent gains of the EUR/USD, there are some technical indicators that have begun to enter strong overbought levels. There are some indicators such as MACD that show an opportunity for more gains for the currency pair until it reaches overbought levels. The variation in performance of technical indicators will be explained by the upcoming performance of the EUR/USD. The bulls are waiting for a breach of the 1.2000 psychological resistance level to increase buying to test stronger highs.

Nevertheless, I still prefer to sell the currency pair from every upward level. The rapid spread of the epidemic in Europe and further restrictions there weaken expectations of an acceleration of the economic recovery of the bloc. In return, the bears will regain control, as the currency pair moves towards the 1.1800 psychological support level.

The currency pair will b e affected today by the announcement of the industrial production rate in the Eurozone and the statements of European Central Bank Governor Lagarde. Later in the day, there will be statements by US Federal Reserve Chairman Jerome Powell.