By the end of last week's trading, the EUR/USD pair jumped to the 1.2100 resistance level, a near two-month high, and closed near that resistance. The recent gains of the euro were strongly supported by the increasing chances of success of the European vaccination campaign, but there are still increasing infections of the virus in many European countries. In this regard, the German Ministry of Health said that the sharp increase in vaccine deliveries in the coming months means that it will likely be able to start offering vaccines to all adults as of June.

Like most countries, Germany is currently prioritizing the vaccination of people most at risk due to age, pre-existing conditions, or exposure to people who are potentially infected.

In a briefing document released by the Health Ministry ahead of Monday's cabinet meeting, officials say that while awaiting additional delivery commitments from AstraZeneca and Johnson & Johnson, "it should be possible to finish setting priorities by June at the latest.

At the same time, they warn that not everyone will be able to get an injection immediately, and that the vaccination campaign will likely continue during the summer as planned. By Friday, nearly 23% of Germany's population of 83 million had received an initial dose of the coronavirus vaccine. At least 7% of the population received both doses.

US President Joe Biden highlighted how the United States administered 200 million doses of the COVID-19 vaccine ahead of his first 100 days in office. He also indicated that it was time for the United States to start sharing overdoses. The striking disparity in vaccines is evident across the Americas, Africa and parts of Asia. China and Russia have pushed hard for homemade vaccines around the world.

But the United States just shared its first 4 million doses last month with Canada and Mexico. Biden said that these countries will be targeted for additional doses, as will Central American countries. Honduras received only 59,000 doses of vaccine for its 10 million inhabitants. Similar gaps in access to vaccines are found across Africa, with only 36 million doses obtained for 1.3 billion people on the continent, as well as in parts of Asia.

In the United States, more than a quarter of the population - nearly 90 million people - have been fully vaccinated. Some states are rejecting planned shipments from the federal government.

The private sector in the Eurozone witnessed growth at the fastest pace since last July as record growth in industrial production was accompanied by a return to growth in the services sector, according to a rapid survey data from IHS Markit at the end of last week. According to the results, the Composite Production Index - which includes manufacturing and services together - unexpectedly rose to a 9-month high of 53.7 in April from a reading of 53.2 the previous month. The result was expected to decline to a reading of 52.8. A reading above the 50.0 level indicates growth. Production jumped for two months after a four-month decline, with the latest growth being the second largest since September 2018.

Commenting on the numbers, Chris Williamson, chief business economist at IHS Markit, said, "In a month during which virus containment measures were tightened in the face of other waves of contagion, the Eurozone economy showed encouraging strength. Although the services sector continued to be severely affected by the lockdown measures, it has returned to growth as companies adapt to the virus and prepare for better times in the future."

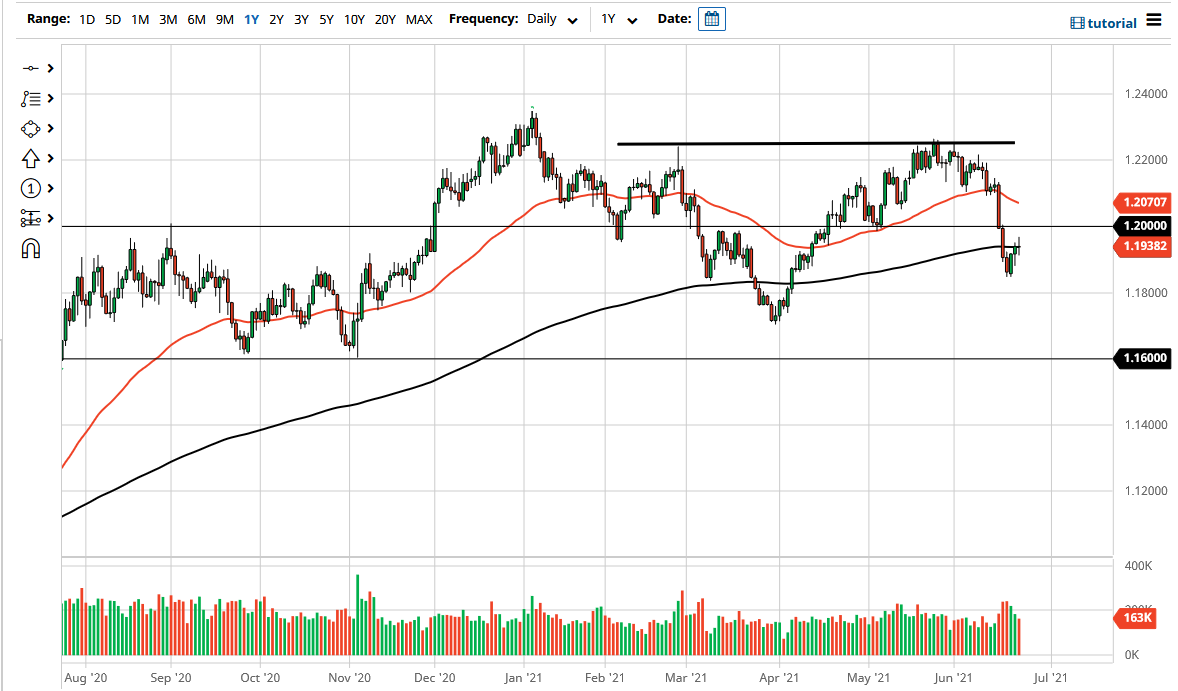

Technical analysis of the pair:

On the daily chart, the EUR/USD is moving in the range of a bullish channel, and further gains above the 1.2100 resistance will push the technical indicators to strong overbought levels. I expect profit-taking selling from the resistance levels of 1.2165, 1.2220. and 1.2310. On the downside, according to the performance over the same period of time, there will be no real reversal of the general trend without the bears moving towards the support level of 1.1860. Economic disparity, permanent stimulus and pollination will ultimately be in the interest of the dollar.

The German IFO business climate reading will be announced, as will the numbers of US durable goods orders.