Better-than-expected results from recent US economic data, especially with regard to the labor market, helped the US dollar achieve more gains before the market holiday. These numbers confirmed that the stimulus plans undertaken by the new US administration will bear fruit quickly. On the other hand, Europe is still suffering from the increase in COVID infections and the imposition of more measures, which delay the path of the expected economic recovery for the year 2021. Accordingly, the price of the EUR/USD remained stable around its lowest in four months, reaching the support level of 1.1704 during last week’s trading, and closing the week’s trading around 1.1786, though bears still have control.

Italy has entered a three-day nationwide lockdown due to the coronavirus to prevent travel and meetings over Easter even as the sudden rise in new infections begins in the country. The government announced last month that it would place all areas in the stricter "red zone" during the Easter holidays to reduce the chances of infection, while taking the same precautions it imposed during Christmas and New Year.

Accordingly, travel between regions and visits to relatives has been restricted until Monday. Unnecessary stores, restaurants and bars are only open for takeout.

The Ministry of the Interior also ordered additional foot patrols to disperse large gatherings in squares and parks, which are usually crowded with picnic-goers during Easter. Italy, where the outbreak began in Europe, has recorded more than 110,000 deaths from COVID-19, more than any other European country except Britain. A further 21,000 injuries were reported on Saturday in Italy, along with 376 deaths.

An estimated 87% of the latest cases in Italy have been traced back to the highly contagious form first detected in Britain. But the Ministry of Health said on Friday that for the second week in a row, new cases "have decreased slightly". Italy provided 10.8 million vaccines across the country, although only 3.3 million of the country's 60 million people had received the two doses. Lombardy, which has a sixth of the population and has long been proud of its healthcare system, gave 1.7 million doses.

In contrast, the US jobs report was impressive and investors hope that it will show that their expectations for a strong economic recovery were justified. Hiring blew past expectations, with employers adding 916,000 more jobs than they cut last month. Economists had expected growth of 617,500 jobs. Job growth was nearly double the rate of job growth in February, and was the strongest since August. The data helped S&P 500 futures climb 0.4%, after the index rose 1.2% to an all-time high. Futures rose for the Dow Jones Industrial Average and NASDAQ.

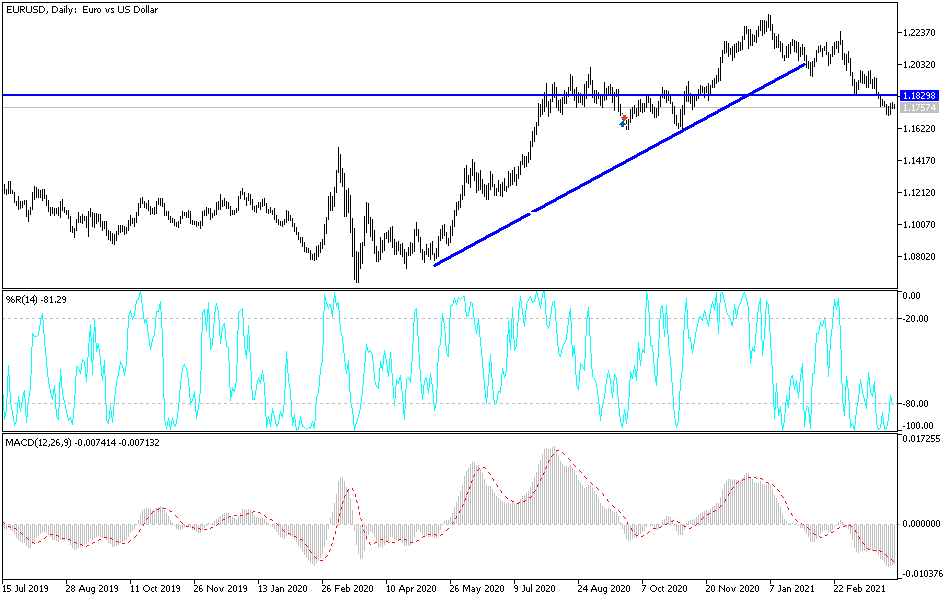

Technical analysis of the pair:

The recent rebound attempts of the EUR/USD did not take the pair out of the range of its sharp descending channel as is the performance on the daily chart below. There will be no first breakout from that channel without a breach of the psychological resistance of 1.2000. On the 4-hour chart, a bullish channel has started to appear, but more momentum is needed to confirm the strength of the rebound. The gains in the EUR/USD will remain subject to profit-taking as long as COVID restrictions remain in place because they impede the path of the European economic recovery.

Investors and markets are now trying to compare the economic situation and restrictions to determine the winning currency, and so far the US dollar is still the strongest. On the downside, the closest support levels for the pair are currently 1.1695, 1.1620 and 1.1545.

Today, amid the European market holiday, the pair will interact with the announcement of the US ISM Services PMI reading, as well as the number of US factory orders.