This is the most important now for more bulls' control over performance. The pair's gains extended to the resistance at 1.1990 before settling around 1.1970 at the time of writing the analysis and ahead of the announcement of a package of important and influential US economic data. This is despite the recent distinguished performance of the single European currency recently. It is possible that the European Union Commission will have to revise its vaccination targets due to the suspension of the Johnson & Johnson-Janssen vaccine, a development that could create new headwinds for the euro’s recent gains against the rest of the currencies.

Johnson & Johnson informed the European Union this week that it has voluntarily suspended the vaccination in Europe due to a link between its vaccine and rare blood clots. The vaccine, developed by Janssen, is a cornerstone of the European Union’s bid to vaccinate at least 70% of the adult population by the end of the summer of 2021.

Part of the euro’s April gains will likely be due to easing investor concerns that the European Union is at risk of being left behind in the global vaccination race as supplies rose significantly in April. Accordingly, the euro gained two-thirds of the percentage against the British pound over the past week, and it gained 0.75% against the US dollar.

Without a single dose of J&J, it would take until December for three-quarters of the European Union's population to be vaccinated, according to Airfinity Ltd. Commenting on this, David Oxley, a senior economist in Europe at Capital Economics, says, "The delay in the delivery of the J&J vaccine is another blow to the spread in the continent of Europe, and it can in itself delay things for at least one month compared to the case in which the pace of recent vaccinations continues."

Accordingly, forex analysts said that the euro will benefit from the acceleration of the European Union vaccination program in April, allowing the forex markets to focus on a strong recovery in the euro area in the second half of the year. In this regard, Zach Pandel, an economist at Goldman Sachs, said in the first week of April, "The pace of vaccinations is expected to accelerate significantly in April and May, and past experience indicates that the current closures will reduce the number of HIV cases relatively soon."

If there is a link between the appreciation of the euro and the acceleration of the introduction of vaccination, then surely any new setbacks to the European Union vaccination program could headwind the euro exchange rates. This week, J&J announced that it will suspend its vaccine launch in the European Union following the suspension of the vaccine deployment in the United States by the US drug authorities.

The U.S. Centers for Disease Control (CDC) and the Food and Drug Administration (FDA) said Tuesday that the program will be suspended while reviewing data on six reported U.S. cases out of more than 6.8 million doses taken. Authorities say they are aware of an extremely rare disorder that affects people with blood clots associated with low platelets in a small number of individuals who have received our COVID-19 vaccine.

As of April 12, more than 6.8 million doses of the J&J vaccine have been administered in the United States, and six cases of a rare and severe type of blood clot have been reported in individuals.

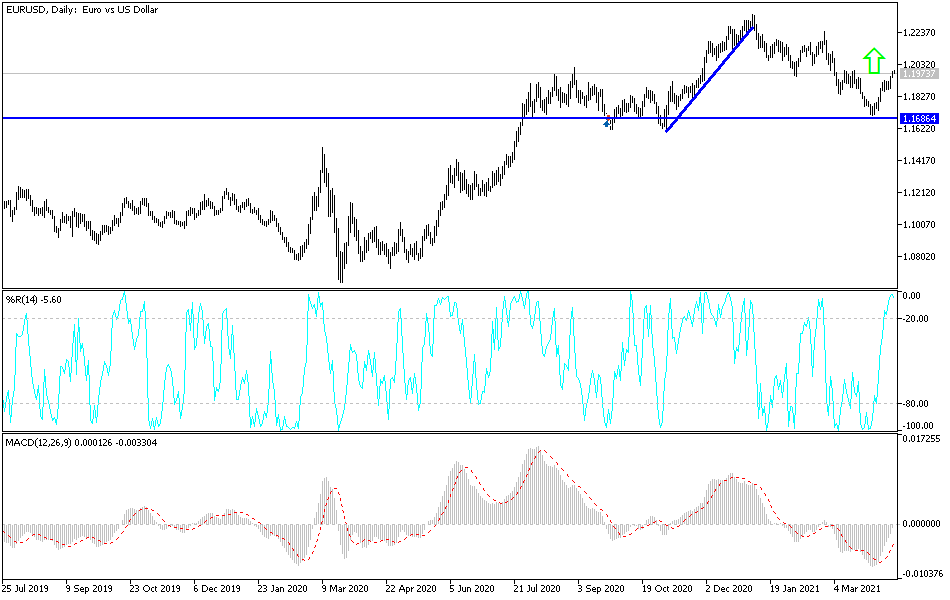

According to the technical analysis of the pair: On the daily timeframe chart, the recent gains of the euro against the dollar, EUR / USD, formed a bullish channel opposite to the strong and continuing general trend since the beginning of trading in 2021. At the moment, the breach of the psychological resistance of 1.2000 will be important for the bulls to rush towards stronger bullish levels. The move in recent trading sessions underscores the extent of the caution on the part of the bulls, and the reason for this is what was mentioned above. Any disruption to European pollination means a rapid collapse of all the euro’s gains. Therefore, we still prefer selling the currency pair from every upside level and the closest resistance levels for the pair, currently 1.2055, 1.2120 and 1.2200, respectively.

On the downside, 1.1860 support will remain the most important for bears to control performance again.

As for the economic calendar data today: The German Consumer Price Index reading will be announced. From the United States, the most important ones are retail sales, the number of weekly US jobless claims, the Philadelphia Industrial Index reading and the industrial production rate in the United States.