The retracement gains of the EUR/USD pair's upward correction were capped by a test of the 1.1878 resistance level, which the pair is near as of this writing. The EUR/USD has found an opportunity to breach above the 1.18 resistance, amid signs from the charts that the downward correction is almost over. But the gains of the euro will be subject to European measures to contain waves of COVID infections and thus impose more restrictions.

The EUR/USD's collapse last week coincided with the rally in the Relative Strength Index (RSI) on the daily charts and what technical analysts call the "bullish divergence". Commenting on this, Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says, “The EUR/USD bottom at 1.1704 last week was accompanied by a divergence in the daily RSI. Coupled with the fact that we have a number of 13 on the daily chart and that we are close to the 1.1695 area, a 38.2% retracement of the move and as we have seen in 2020, we have exited the remaining short positions. We have TD support at 1.1648 and the pre-2008-2020 downtrend is at 1.1570.”

Differences between prices and oscillators such as the Relative Strength Index (RSI) are warning signs of a pending change in the fundamental trend and in this particular case, the divergence indicates the possibility of a potential turnaround for the EUR.

Accordingly, the Commerzbank team turned bullish for the EUR/USD pair, buying around 1.1805, but they warned that the euro might encounter resistance at its 200-day moving average around 1.1882 and said it needs to rebound above 1.2014 in order to fully reach the upward trend's strength. The latter is something that likely requires a recession of the third wave of COVID in Europe and for the bloc to make progress in vaccinations, due to the high number of infections that have been witnessed recently, as Belgium, France and others have returned to "lockdown" while the European Union remains behind its peers in vaccinations.

The dollar gained a strong and continuous momentum in the recent period due to the combination of the rapid launch of the vaccine and the unusually huge government spending on financial support for families, which raised expectations about the growth of the US economy, and in return, Europe was suffering from weak stimulus, the problems of purchasing the vaccine and a third wave of infection with COVID-19.

International Monetary Fund data showed that the dollar in global foreign exchange reserves fell to its lowest level since 1995 in the last quarter of 2020, at 59%, which reflects a limited erosion of its position as the dominant global reserve currency in addition to the development of the global reserve currency. Meanwhile, the euro’s share rose to $2.5 trillion and 21.2% of the total, the largest since 2014, while it could give hope to European officials looking for a more prominent international role for the euro.

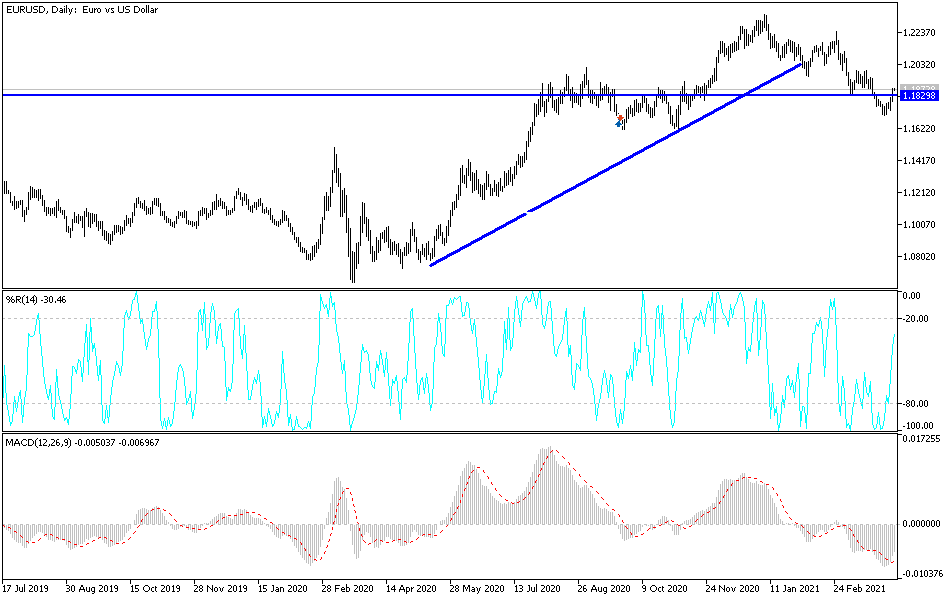

Technical analysis of the pair:

As long as the Eurozone is stuck in the difficult COVID situation that it is, the current bullish reversal of the EUR/USD currency pair will be limited and subject to profit-taking at any time. A technical shift into an uptrend for the currency pair will not occur without stability above the 1.2000 psychological resistance. The euro’s current gains will be affected by the reaction to the release of the minutes of the last US Federal Reserve meeting. Prior to that, the Service PMI readings for the Eurozone economies will be released.

On the downside, the bears will regain control over the performance of the EUR/USD by returning to below the 1.1800 level as it was for two weeks in a row.