Despite the reopening of some European economies, the gains of the EUR/USD stopped at the 1.2117 resistance level before stabilizing around 1.2075 as of this writing. The pair is awaiting incentives to complete the recent upward correction. In Italy, after six months of repeated closures, restaurants, bars, museums and cinemas have opened to the public in most parts of the country under a gradual reopening plan seen as too cautious for some, and too hasty for others.

Virologists and health care workers in the country fear that even the initial reopening set by the government of Prime Minister Mario Draghi will call for caution about things getting out of control again, and the government's vision is that renewed economic activity is for a gradual reopening, beginning with swimming pools. Tourism will follow next month, gyms after that and larger events and exhibitions from mid-June. A sum of 200 billion euros ($241 billion) will be collected and may contribute to the recovery of the European Union and Italy.

The reopening is coming even as Italy's intensive care wards remain above the 30% warning threshold. The Italian vaccination campaign is also still shy of its target of 500,000 doses per day and is now only moving to protect people in the 70-79 age group. The World Health Organization says people over the age of 65 account for the vast majority of COVID-19 deaths in Europe.

This caused concern to virologists, who noticed that the virus was adept at transforming itself with lethal variants, and that the curve in Italy had only recently been brought under control, and could easily rise again.

A closely watched index of German business expectations rose in April, as the third wave of coronavirus infections hampered optimism about the pace of recovery after the pandemic. Therefore, the German Ifo Business Climate Index rose to a reading of 96.8 points from a reading of 96.6 for the month of March, as companies viewed current conditions as better but expressed less optimism about the next six months. Germany, along with the rest of Europe, is fighting a renewed battle with higher levels of infection, as the variant that spreads more easily becomes the dominant strain. More than 5,000 people are in intensive care with COVID-19.

The Munich-based Ifo Institute cited, as a multiplier, that about 45% of industrial firms reported bottlenecks between suppliers, the largest number since 1991. Automobile companies have experienced shortages of semiconductors, forcing them to curb production. Economists are expecting a major rebound towards more normal levels of activity at the end of the year after the acceleration of vaccination campaigns.

Commenting on the numbers, Carsten Brzezki, an analyst at ING Bank, said: “The Ifo index for April indicates a temporary halt in the German recovery as the lockdown continues. However, prospects for a strong recovery in the second half of the year remain."

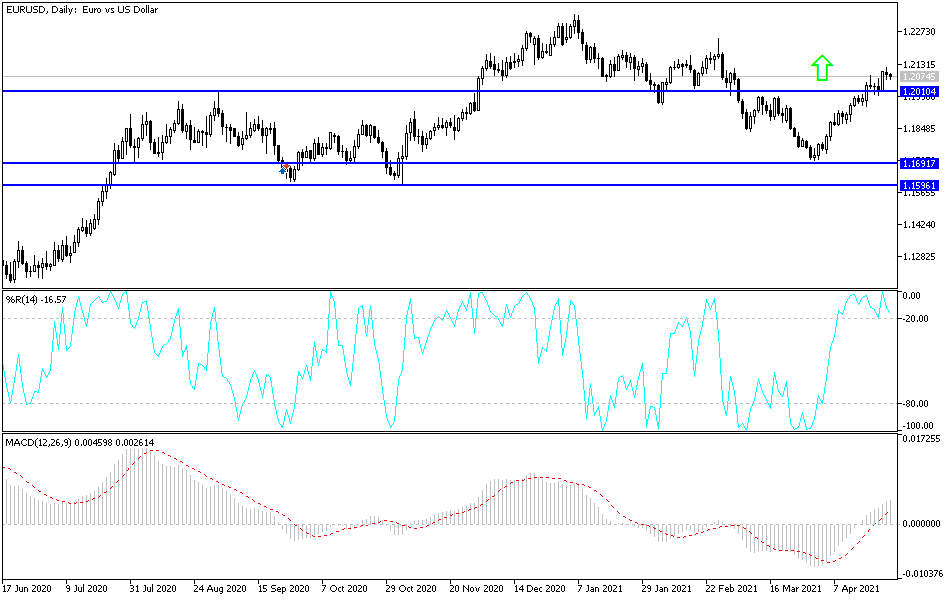

Technical analysis of the pair:

There is no change in my technical view of the EUR/USD, as stability remains above the psychological resistance of 1.2000 that benefits the bulls. Unless the currency pair gets more momentum, profit-taking may occur soon, especially with some indicators moving to overbought levels following the recent gains. The closest resistance levels for the currency pair are currently 1.2145, 1.2220 and 1.2300. On the downside, and as I mentioned before, the bears will regain control over the performance if the currency pair moves below the support level of 1.1865. I still prefer to sell the currency pair from every upward level.

The pair does not expect any important European economic data today. From the United States, the US consumer confidence reading will be released.