The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a good time to be trading markets right now, as there are a few valid long-term bullish trends in major U.S. and European stock market indices, which can be traded at most Forex brokers as CFDs.

Big Picture 18th April 2021

Last week’s Forex market saw the strongest rise in the relative values of the New Zealand dollar and the strongest fall in the relative value of the U.S. dollar.

I wrote in my previous piece last week that the best trades were likely to be long of the S&P 500 Index and of Bitcoin (BTC/USD) following a daily (New York) close above $61,165. While the S&P 500 Index rose over the week by 1.47%, but Bitcoin closed Friday down by 3.35% from its daily close on Tuesday, giving an average loss of 0.94%.

Fundamental Analysis & Market Sentiment

The headline takeaway from last week is that market sentiment is risk-on, especially in the U.S. and the Eurozone centered on Germany. Demand has been stoked by dovish monetary policy plus stimulus in the U.S., despite fears that policy will lead to untenable inflationary pressures. The week ended with the major U.S. stock index, the S&P 500, again closing at an all-time high price of 4185.50 – the second consecutive weekly close above 4000, while the Dow and the NASDAQ also closed at record highs. European stock markets also hit record highs, with the DAX Index also ending the week at a record high of 155398.

The U.S. dollar fell over the past week after running into technical resistance two weeks ago, while its long-term trend is mixed.

Last week saw the New Zealand dollar rise after the Reserve Bank of New Zealand kept a steady course in its monthly policy release. The major data releases last week concerned the U.S. dollar, with stronger-than-expected retail sales and inflation data indicating a booming economy. FOMC member Kaplan a few hours ago forecasted that 2021 GDP growth in the U.S. will ultimately be an increase of 6.5%, a historically very large figure which has not been surpassed since 1984.

The main events this coming week will be policy inputs from the European Central Bank and the Bank of Canada, as well as British, Canadian and New Zealand CPI numbers.

Last week saw the global number of confirmed new coronavirus cases rise for the seventh consecutive week after falling for over two months, driven mainly by a resurgence of the virus in Europe and Latin America (especially Brazil). The total number of global deaths also rose again last week for the fourth week running. The number of new daily cases is close to its all-time high made in early January.

Many countries have begun vaccination programs. Excepting extremely small nations, the fastest progress towards herd immunity has taken place in Israel, the U.K. and the U.A.E. with studies claiming that Israel and the U.K. have reached de facto “herd immunity”. Immunization is proceeding quickly in the U.S. but is going slowly in the European Union, where only two member states have inoculated more than 20% of the population (Hungary, Finland, and Lithuania).

The strongest growth in new confirmed coronavirus cases is happening in Argentina, Azerbaijan, Bahrain, Canada, Chile, Colombia, Croatia, Cyprus, Egypt, Georgia, Germany, Guatemala, India, Iran, Iraq, Japan, Kazakhstan, South Korea, Kuwait, Latvia, Lithuania, Malaysia, Mongolia, Netherlands, Oman, Pakistan, Philippines, Qatar, Saudi Arabia, Sweden, Trinidad, Tunisia, Turkey, and Uzbekistan.

Technical Analysis

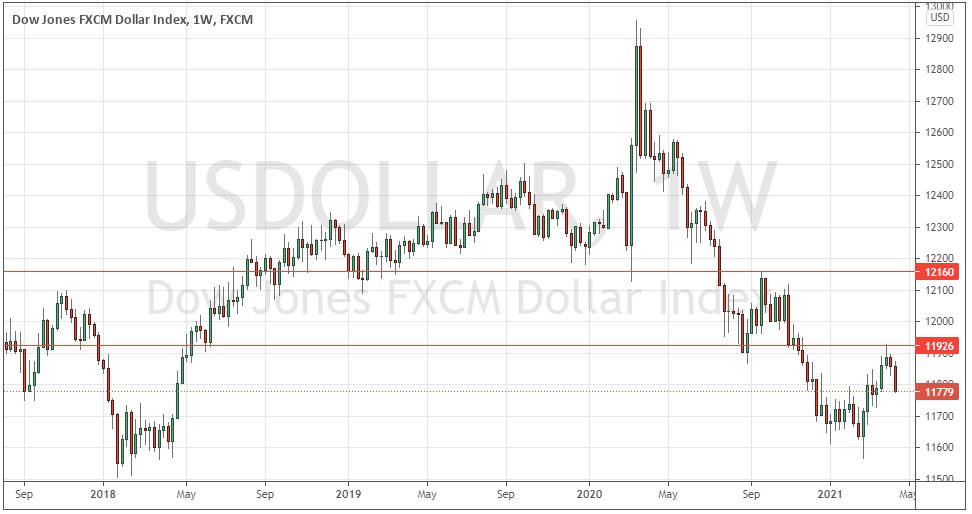

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a strongly bearish small near-pin candlestick last week after rejecting the key resistance level a few weeks ago shown above the current price in the chart below and making a bearish reversal. The index is above its price from three months ago which is a bullish sign, but is still below the key resistance level mentioned as well as sitting below its price from six months ago, suggesting that the upwards movement may be capped over the near term. Overall, next week’s price movement in the U.S. dollar looks slightly likely to be downwards. For this reason, it will probably be wise to not take any long USD trades over the coming week.

S&P 500 Index

The incredible rise of the U.S. stock market since the initial impact of the coronavirus in March 2020 continues, with the price powering up last week to close right on yet another all-time high. An additional bullish factor is that the closing price was again well above the big round number and psychological level at 4000. The price is in blue sky with bullish momentum, and the volatility is healthy enough to suggest the rise is likely to continue for some days.

DAX 30

Despite slow progress in stopping the spread of coronavirus, the Eurozone’s economic prospects have been seen increasingly positive by market analysts over the past few weeks. The end of last week saw the rise in the German DAX Index outpace the increase in value shown by major U.S. market indices, suggesting trading the DAX 30 long could be an interesting approach over the coming week, as the price takes off into blue sky making fresh all-time high prices.

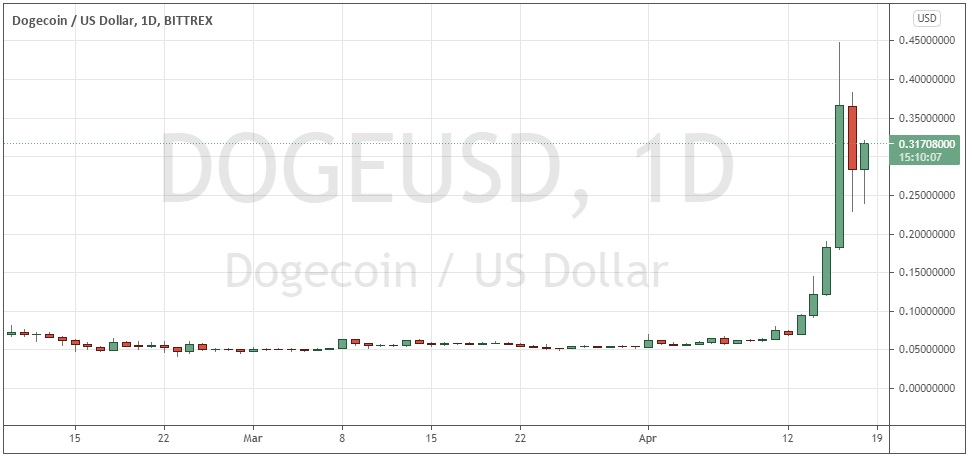

Dogecoin

Dogecoin, a cryptocurrency started as a joke, has become the subject of intense speculative interest in recent weeks as Elon Musk started to talk it up in his tweets, predicting it would go “to the moon”. At the end of last week, it seemed Dogecoin finally obliged, rising by an astonishing 500% over the week to the peak price made just under 45 cents per coin.

Trading Dogecoin is highly risky, but the residual bullish momentum and high volatility may be something a crypto day trader could exploit over the coming week.

Bottom Line

I see the best likely opportunities in the financial markets this week as being long of the S&P 500 and DAX 30 Indices.