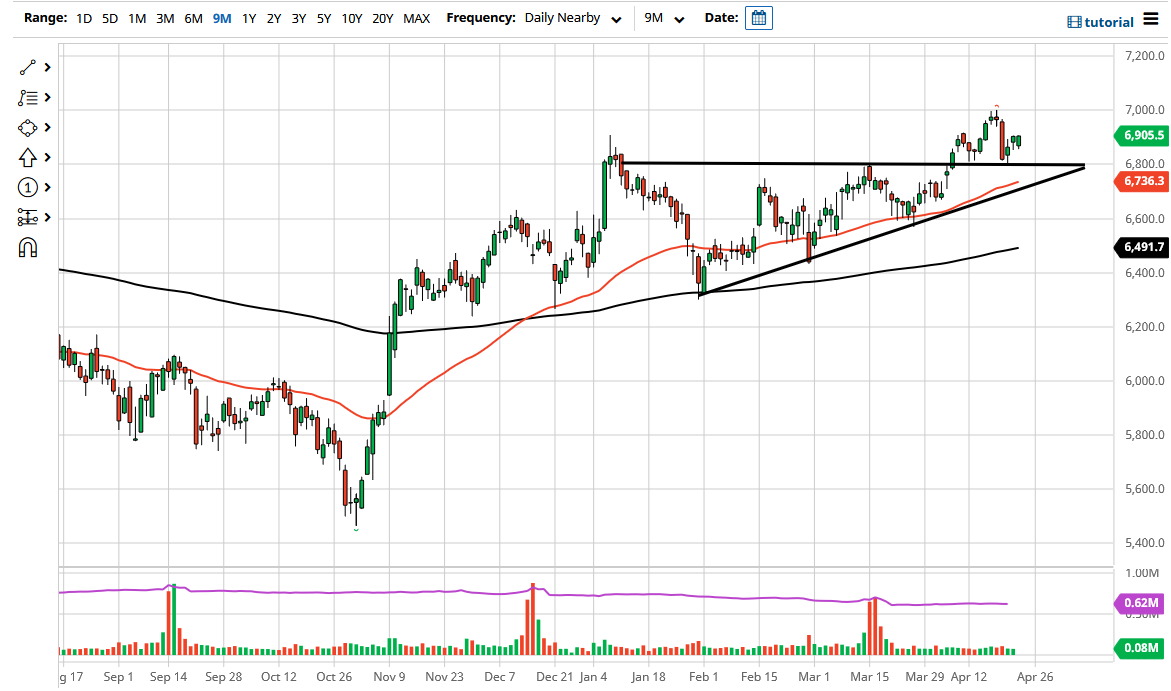

The FTSE 100 had a positive session on Friday to close out the week, after pulling back a bit over the last couple of days. That being said, the one thing that is worth paying the most attention to is the fact that we bounced from the 6800 level, which was the top of the ascending triangle that the market had been paying so much attention to previously. By bouncing from there and continuing to go higher, the market looks as if we will continue to see bullish pressure.

The massive red candlestick from earlier this week still has not been taken out, so I think a lot of traders are a little bit cautious about jumping in with both feet. However, we are in an uptrend, so I do think that eventually we will at least try to get above there, which is sitting just below the 7000 handle. The 7000 handle is a large, round, psychologically significant figure, and I believe that it is only a matter of time before we have to sort that situation out. If we can clear there, then the market is likely to go much higher, perhaps reaching as high as the 7300 level. The 7300 level is a target that I get based upon the measurement of the height of the triangle, so it is the “measured move” that a lot of technical traders will be aiming for. Furthermore, we been going higher anyway.

Even if we broke down below the 6800 level underneath, I believe that the 50-day EMA will be crucial as well, as it has been climbing the uptrend line from the triangle as well. I have no interest in shorting this market, and I do think that we will continue to see a lot of liquidity out there coming into the markets to push the index higher, just as we see in multiple other countries. This does not mean that we will go straight up in the air, but it does mean that the market still favors the upside.

If we broke down below the uptrend line from the triangle, then it is likely that the 200-day EMA would come back into the picture to offer significant support, as it is a long-term trend-defining indicator.