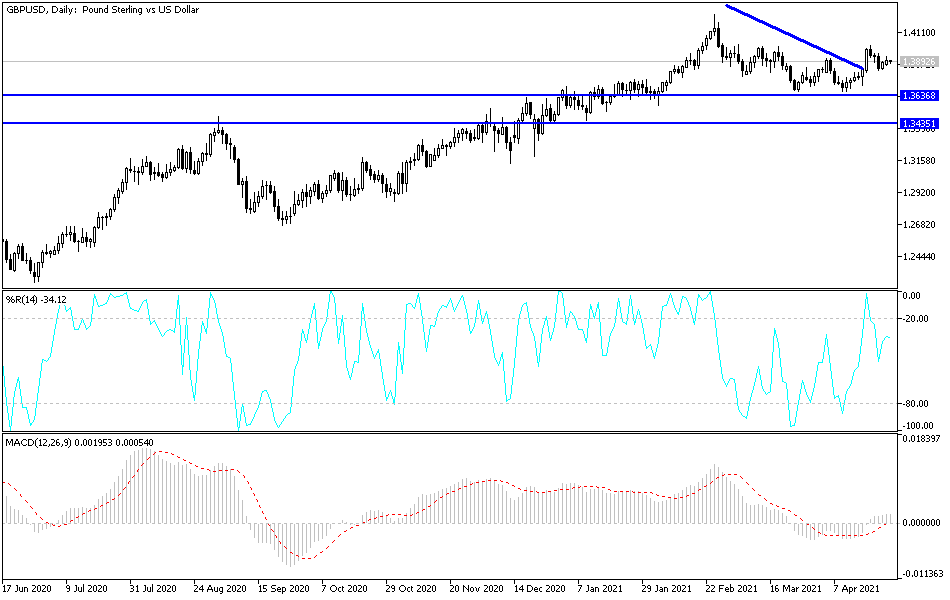

The British pound initially shot higher during the trading session on Wednesday but continues to show a bit of confusion as we gave up most of the gains. By forming a shooting star, it shows that the market is not quite ready to go higher, and we have clearly seen that the 1.40 level offers a significant amount of resistance. In fact, we are seeing this across the board when it comes to the US dollar, there are areas that the US dollar simply will not move past.

This could be a sign of something bigger, but in the meantime, we simply look at this as a market that is chopping back and forth in trying to consolidate. There are a lot of things going on in the world that could move markets in either direction, so it must be approached with extreme caution. It is not until we break above the 1.40 level that I would feel a bit more confident about going long of the market. It is not that I would not be a buyer on a dip, just that I would not buy a huge position.

To the downside, you can see that the 50-day EMA sits just below, and the double bottom underneath also comes into play. If we were to break through all of that, it is likely that the British pound would go looking towards the 1.35 level, which is quickly seeing the 200-day EMA race towards it. Below there, the entire uptrend is destroyed.

There are a lot of moving pieces when it comes to the British pound right now, not the least of which is whether or not there are going to be lockdowns again. It seems as if Great Britain is not quite ready to get things going, most certainly not like the Americans are, and the US continues to lead the rest of the world when it comes to the reopening trade. It is in this sense that I think the British pound will be sluggish to say the least. However, if we do get that breakout above the 1.40 handle, and then eventually above the 1.42 level, then we could be looking at a larger “buy-and-hold trade.” Until then, you need to be very cautious about your position size, and make sure you are not over-extended.