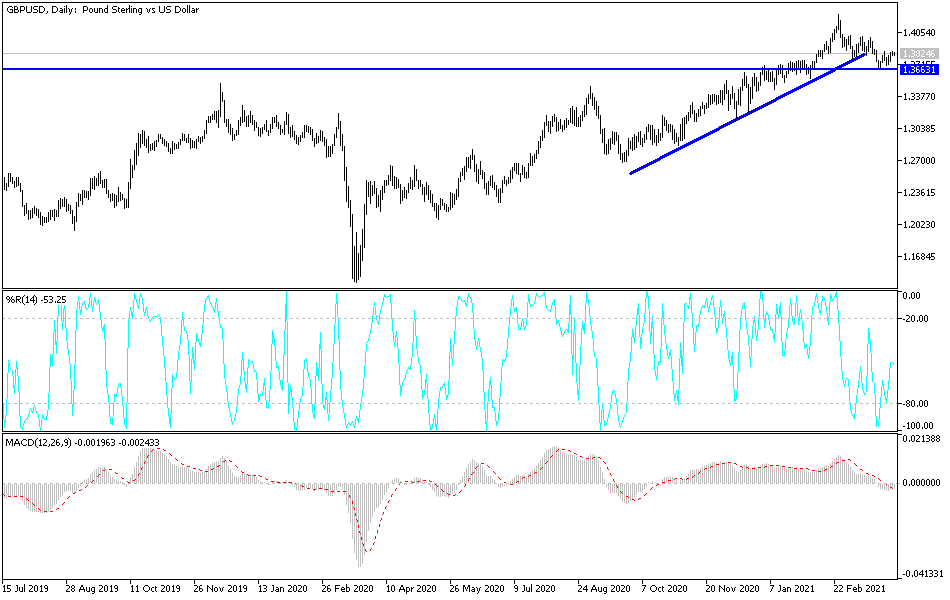

The British pound fluctuated during the quiet Good Friday session, but at the end of the day we are looking at a market that is simply consolidating above the 1.3750 level. The 1.3750 level is an area that has been resistance in the past, so it certainly makes sense that it would be supported now. The 50-day EMA flattening out also suggests that the market is not quite sure what to do at the moment, but it is worth noting that we continue to see buyers on dips, despite the fact that we have had a slight correction over the last six weeks or so.

The British pound has been rather resilient in general, and has been in a major uptrend for months, with the exception of the most recent trading. You can also make an argument that we are in the process of forming a falling wedge, which is a bullish sign as well. I believe that not only do we have that to pay attention to, but we also have significant support extending down to the 1.35 handle. Just below the 1.35 handle, we have the 200-day EMA coming into the picture as well, so that is yet another reason to think that there should be a certain amount of support there.

If we do break above the short-term resistance which I see as the 1.3870 level, then the market should go looking towards the 1.40 level after that. The 1.40 level is a large, round, psychologically significant figure, but it is also an area where we have seen a lot of downward pressure recently. However, if we can finally break above there then the market will go testing the 1.40 level above, which is important on longer-term charts, and where we had peaked recently.

I do not think that we can get through there easily, and I think it is going to be a grind to the upside the entire time. I have no interest in shorting this market, even though I think the US dollar will probably do fairly well against multiple other ones. The British pound enjoys the benefit of being historically cheap, and the fact that 30 million Britons have at least received the first dose of their coronavirus vaccine.