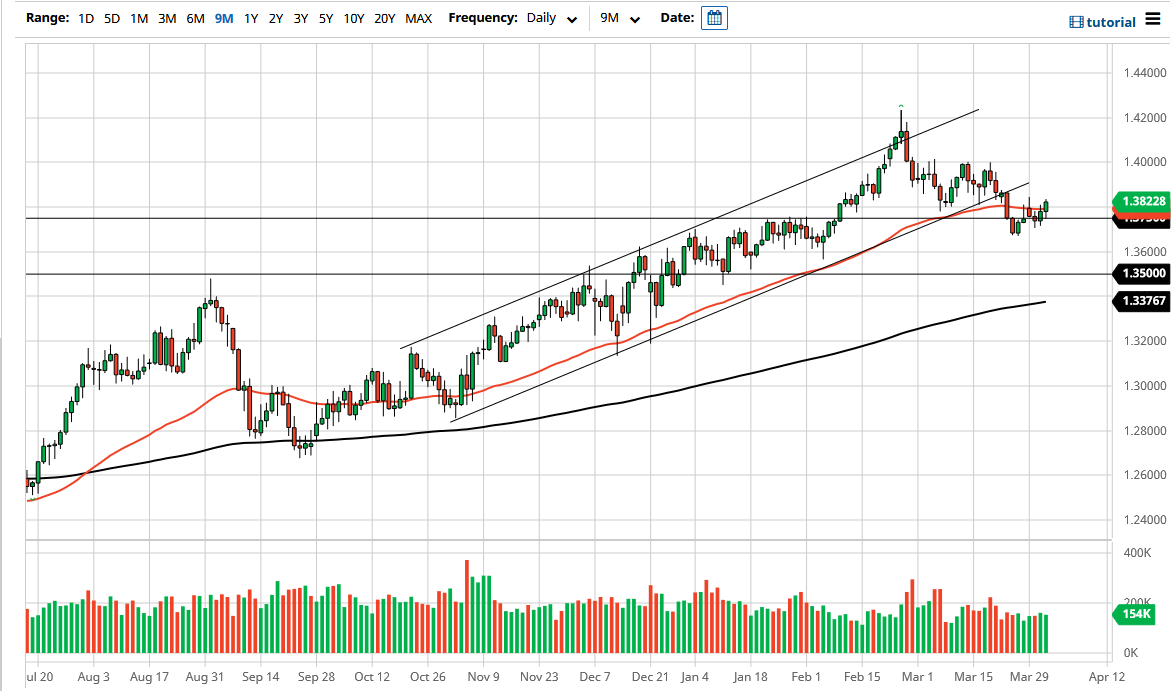

The British pound has rallied significantly during the trading session on Thursday, as the 1.3750 level has been important more than once. Because of this, it is worth noting that we have bounced from there again, and the 50 day EMA is slicing right through the candlestick. I think there will be a lot of noise in this area, but you should keep in mind that it is Good Friday, so once we get later in the day there will probably be almost no liquidity.

To the upside, if we do break out, I believe that we would go looking towards the 1.40 level. The 1.40 level is a major barrier, which opens up the possibility of a move towards the 1.42 handle. That level is significant resistance on the longer-term charts, and therefore I think a lot of people will be paying close attention to the area if and when we get there.

To the downside, if we break down below the recent lows that could open up a move down to the 1.35 handle, an area that should be massive support. If we break down below that level, then it would be an extraordinarily negative turn of events. However, until that happens, I think that we are more than likely going to find buyers looking for value, and therefore I look it dips as potential buying opportunities. Although the US dollar has been very strong, the British pound has been somewhat resilient against most currencies.

The next 24 hours will be very quiet, but I think what we need to pay close attention to is where traders feel comfortable going into the weekend. If they do show signs of strength, that is probably a sign that we are in fact going to go higher. However, with the US dollar showing signs of strength, actually prefer shorting the EUR/GBP pair rather than to get bothered with trying to go against the greenback in the short term. That being said, if I was forced to take a trade in this market it is going to be to the upside as although we have seen a bit of negativity over the last month or so, when you look at the longer-term it is simply a pullback in a strong uptrend.