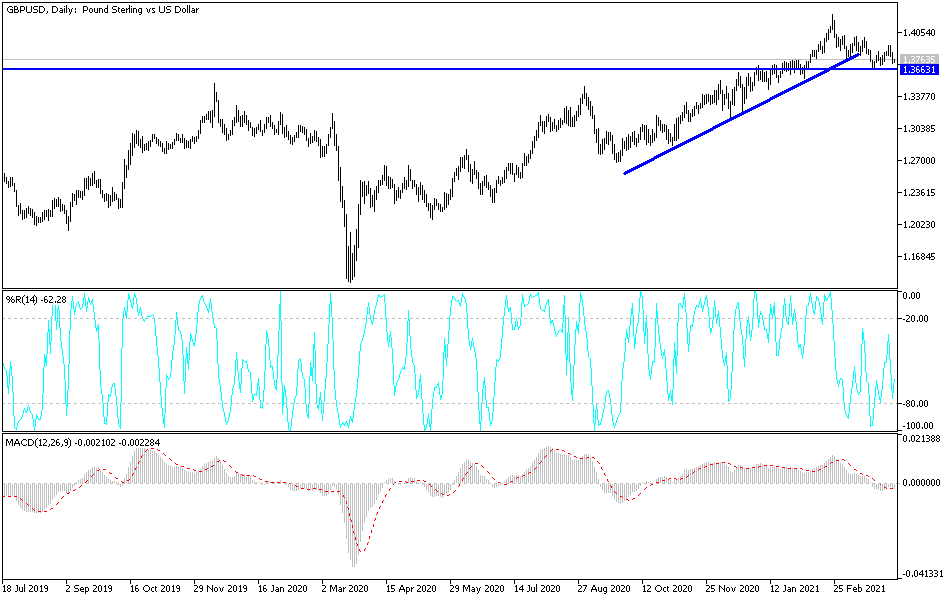

The British pound fell again during the trading session on Wednesday to reach down towards the 1.3750 level yet again. This is an area that seems to be a bit of a magnet for price, as it had previously been significant resistance, only to turn around and become support multiple times since then. Furthermore, the 50-day EMA is slicing right through the candlestick, so I think that given enough time we are probably going to be looking at a scenario where traders are going to be waiting for some type of impulsive candlestick in order to get involved.

It should not be forgotten that we are still in an uptrend, so you need to be looking at this market as one that offers buying opportunities only, at least for now. I believe that the area of support extends all the way down to the 1.35 handle, so that ks something that needs to be kept in the back of your mind. The 200-day EMA is at the 1.34 handle, but it is reaching towards that significant 1.35 level, and I think that there will be a huge convergence of support.

If we turn around and rally, I think that the market could go towards the 1.39 level, and then eventually the 1.40 level. The 1.40 level above has been significant resistance multiple times, so I do think that it would probably be resistance again if we reach towards it. Breaking above that level opens up the possibility of a move towards the 1.42 handle, which is a large, round, psychologically significant figure, but it is an area that has been structurally important. If we were to break above the 1.42 level, that could send this market much higher. At that point in time, we could be looking at a move towards the 1.45 handle, but it is obvious to me that the US dollar has put up a significant fight. I suspect the best way to look at the British pound right now is that it has performed a bit better than most of its other counterparts against the greenback, but it is also worth noting that it has struggled in general. With that being the case, if I were to short the US dollar, I probably would do it here, but I do not have a signal to get long quite yet.