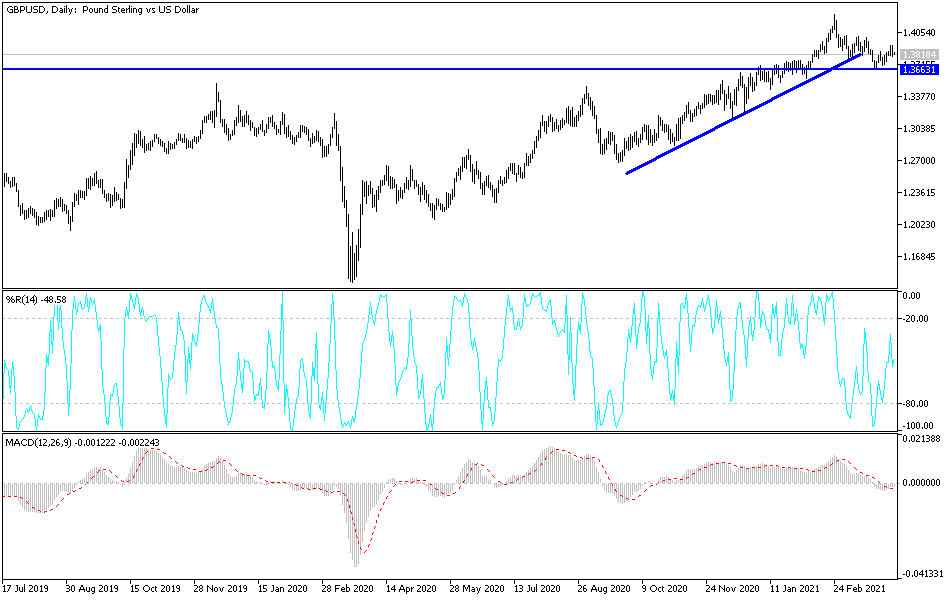

The British pound initially tried to rally during the trading session on Tuesday but gave back the gains to fall towards the 50-day EMA. There is a significant amount of support in this region, so I think that the selling of the British pound is going to be somewhat limited. After all, the British pound has outperformed most other currencies against the greenback for some time, and I do not see that changing anytime soon.

The 50-day EMA continues to be important, so I think what we are looking at here is a retest of that area and then the 1.3750 level. The 1.3750 level should offer support based upon the fact that it has been previous resistance. We have bounced quite nicely from there as of late, and now I think we are simply trying to build up the necessary momentum to make that move. However, if we look at the attitude of markets in general, we have seen a little bit of a softening of the greenback during the session while the British pound pulled back. I do not think this will last very long, so at this point I am looking for buying opportunities just below.

The support level underneath extends all the way down to the 1.35 handle, so I do not really have a scenario in which I am selling anytime soon. The 200-day EMA sits just below the 1.34 handle, but I think that by the time we break down below the 1.35 handle it would be a bit of a disaster for the British pound. Currently, I am simply sitting on the sidelines and waiting to see some type of supportive candlestick in order to start buying again, as I believe that the market will eventually go looking towards the 1.40 level again. That is an area that I think will continue to be difficult, but if we can break above there it is likely that the market is going to go towards the 1.42 handle. Looking at this chart, the market is struggling compared to what we had recently seen, but there is still plenty of support underneath that could come into play and push to the upside.