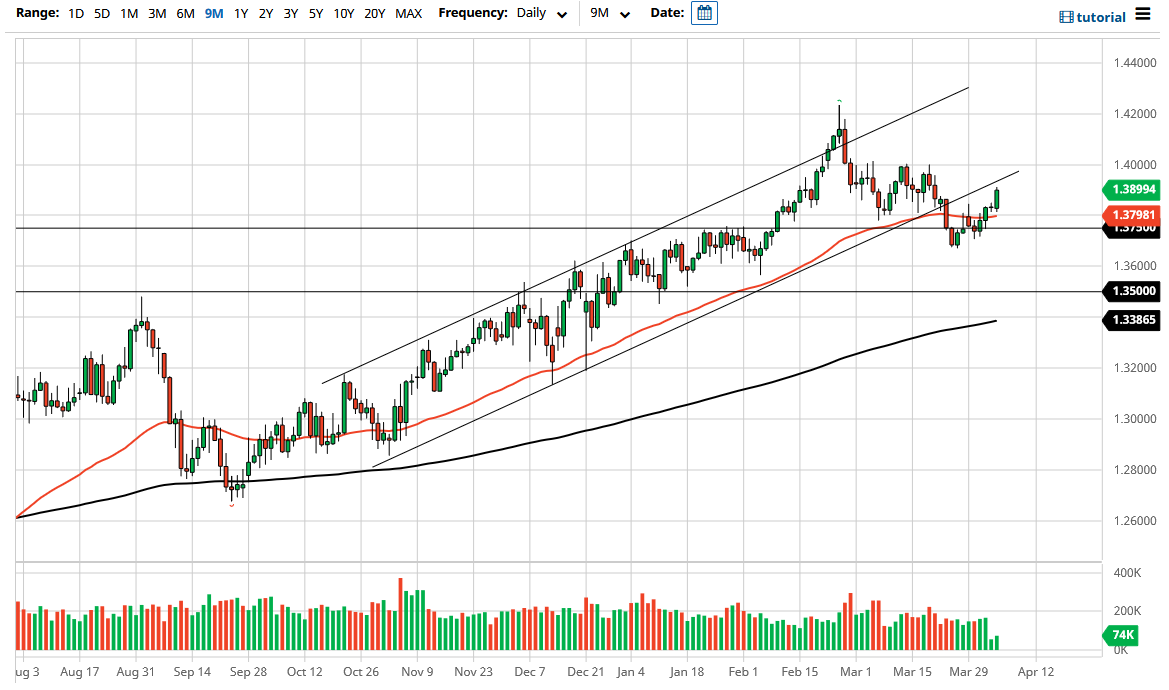

The British pound has rallied significantly during the course of the trading session on Monday as traders came back. It should be noted that the Europeans were celebrating Easter Monday, so liquidity may have been a bit of an issue during certain parts of the session. That being said, the market looks as if it is trying to decide whether or not we can break above the 1.39 level and continue going higher. If that is the case, it is likely that the market is going to go looking towards the 1.40 level again, an area that has been important more than once.

If we can break above that 1.40 level, it allows the British pound to go much higher, perhaps reaching towards the 1.42 level. The 1.42 level is an area on the weekly charts that has been significant resistance in the past so I think it is only a matter of time before we will have to go to the upside in order to test that level. I also believe that it would take several attempts to break out above there, so it will be interesting to see whether or not we actually can make that happen.

If we were to get a daily close above the 1.42 level, then I think at this point in time it is only a matter of time before we go looking towards the 1.45 handle after that. The 1.45 handle is a large, round, psychologically significant figure that of course will attract a lot of attention, and as a result I suspect that there would probably be a significant amount of profit-taking in that general vicinity.

The British pound continues to strengthen based upon what we have seen, and I think the British pound has been a bit of an outlier when it comes to the way the currency behaves against the greenback. Because of this, even if we do get a US dollar strength, it should be noted that the British pound has been a bit stronger than some of its other counterparts. It looks to me as if the market is presently trying to form a “buy on the dips” type of rally, and that is exactly what I plan on doing as the 50 day EMA is sitting underneath and offering significant support for the short term.