Bullish View

Buy the GBP/USD and set a take-profit at 1.3750 (March 29 high).

Add a stop loss at 1.3700.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 3700 and a take-profit at 1.3650.

Add a stop-loss at 1.3750.

The GBP/USD declined for the first month in six months in March as the market focused on the higher US bond yields and the stronger dollar. The pair is trading at 1.3780, which is slightly above the year-to-date low of 1.3670.

UK and US PMI Data Ahead

The GBP/USD reacted mildly to the latest spending plans in the United States. The Biden administration plans to spend more than $2.3 trillion to boost the country’s infrastructure. The funds will go to transportation, green housing, manufacturing subsidies, elder and disability care, and broadband and job training.

He expects to fund these projects by raising corporate taxes, repealing tax loopholes, and ending fossil fuel subsidies. He also plans to increase more taxes on Americans making more than $400,000 a year. If approved, the $2.3 trillion plan will bring the total stimulus offered this year to almost $5 trillion. This will also lead to higher US bond yields and a relatively stronger dollar.

Today, the GBP/USD will react to the latest UK and US Manufacturing PMI numbers. In the UK, based on the flash PMI data released last week, analysts expect the number to show that the PMI rose to 57.9 in March. The trend will likely continue as the US makes substantial progress on administering the coronavirus vaccine.

In the United States, Markit and the Institute for Supply Management (ISM) will also publish Manufacturing PMIs. The Markit figure is expected to come in at 59.0 while the ISM is expected to rise from 60.8 to 61.3. The US will also publish the latest initial jobless claims numbers. Last week, the data revealed that more than 684,000 people filed for initial claims, the lowest figure since the pandemic started.

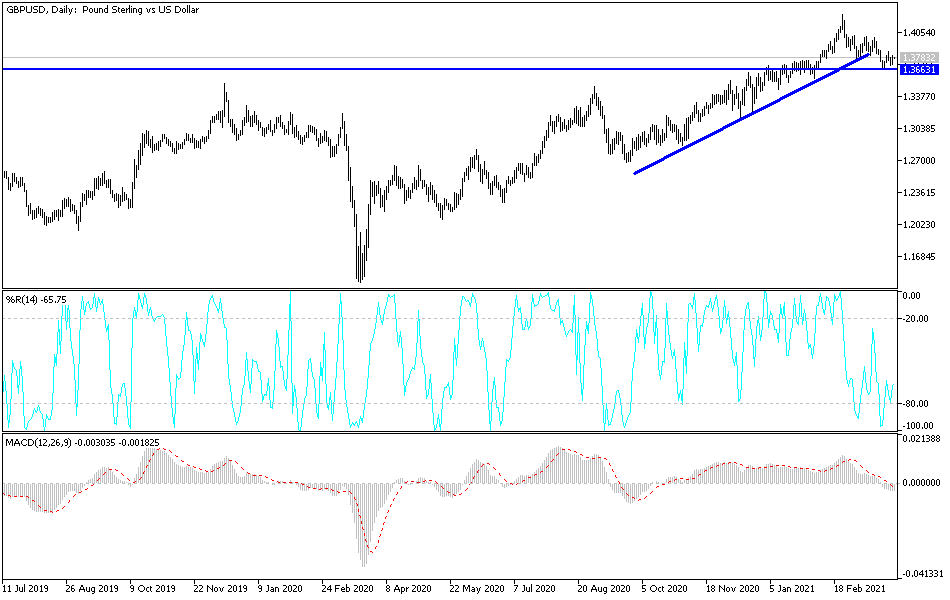

GBP/USD Technical Outlook

The GBP/USD pair is holding steady at the 1.3780 level. On the four-hour chart, the price is slightly below the 61.8% Fibonacci retracement level at 1.3820. It also dropped slightly below the 25-day and 15-day exponential moving averages (EMA).

The price is also slightly below the important resistance at 1.3800, where it had found substantial support in March. Therefore, the pair may keep rising as bulls target the next key resistance at 1.3850, the highest level on March 29. However, a drop below 1.3700 will invalidate this trend.