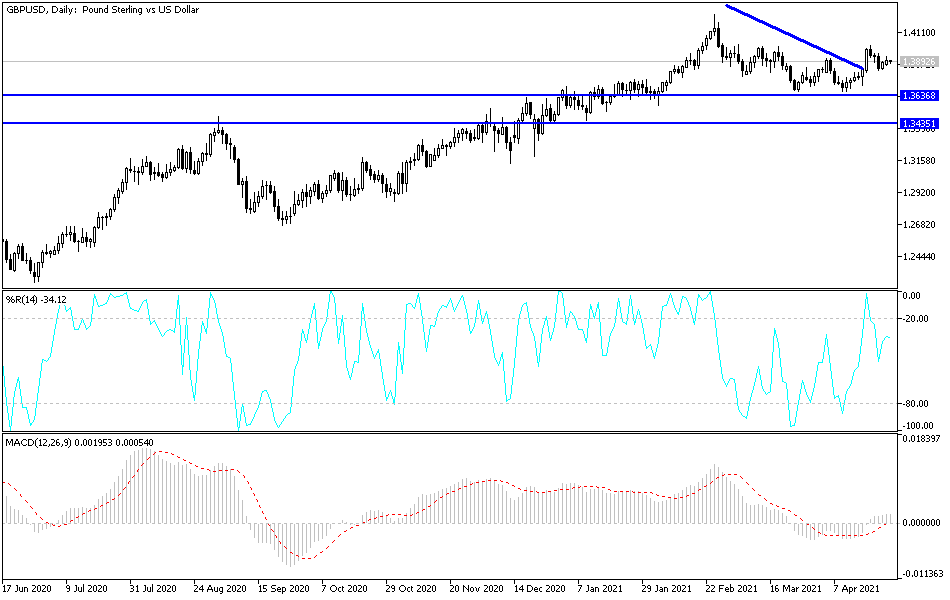

Bearish View

- Sell the GBP/USD and place a take-profit at 1.3788 (First support of standard pivots).

- Add a stop-loss at 1.3925 (right shoulder).

- Timeline: 1 -2 days.

Bullish View

- Set a buy stop at 1.3925 and a take-profit at 1.4000 (last week’s high).

- Add a stop-loss at 1.3850.

The GBP/USD price retreated in the American and Asian sessions as focus remained on the upcoming Fed interest rate decision. It is trading at 1.3877, which is 1% below last week’s high of 1.400.

Fed Decision Ahead

With no major economic data scheduled from the UK this week, the focus will be on the Federal Reserve interest rate decision that will come out tomorrow. In it, economists expect that the central bank will leave interest rate unchanged.

Nonetheless, the bank could also signal its willingness to taper its asset purchases since the economy has started to rebound. The unemployment rate has fallen to 6% from last year’s high of almost 15% while the headline inflation has surged to above its target of 2.0%.

Further, recent flash data showed that the Manufacturing and Service PMIs surged in April while the housing sector has continued to rebound. At the same time, US equities are doing well, with the main indices being close to their all-time highs.

According to FactSet, more than 70% of companies that have reported their earnings have beat the consensus estimates. Therefore, the GBP/USD will react significantly in case of a major change of language.

The GBP/USD pair is also reacting to the hopes of a faster recovery in the United Kingdom. On Friday last week, data by Markit revealed that the manufacturing and services sector had a strong rebound in April as the country continued its recovery phase. Other recent numbers like inflation and retail sales have continued doing well. This trend will continue as the country continues to reopen.

GBP/USD Forecast

The GBP/USD pair declined slightly during the Asian session. On the four-hour chart, the pair has formed a head and shoulders pattern. It has also moved slightly below the 25-period and 15-period exponential moving averages (EMA) and the 50% Fibonacci retracement level.

The pair is also between the median and first support of the Andrews Pitchfork tool. Its volume has also remained relatively stable. It is also trading at the same level as the standard pivot point. Therefore, the pair seems to be ripe for a bearish breakout. If it happens, it will likely see it dropping to the first support of the pivot point at 1.3787. However, a move above the right shoulder at 1.3932 will invalidate this trend.