Bearish View

Set a sell-stop at 1.3721 (overnight low).

Add a take-profit at 1.3650 (second support of pivot points).

Set a stop loss at 1.3800.

Bullish View

Set a buy-stop at 1.3800 and a take-profit at 1.3882 (first resistance).

Add a stop loss at 1.3700.

The GBP/USD price declined in the overnight session as the market reflected on the US bond yields after the latest FOMC minutes. It is trading at 1.3755, which is 1.15% below the highest point yesterday.

FOMC Minutes

The Federal Reserve published the minutes of the meeting held on March 16 where the bank decided to leave all pandemic response tools intact. It left interest rates at near zero and hinted that it will continue buying assets at a pace of $120 billion per month until economic conditions improve.

They pointed to the uneven pace of recovery where many businesses are struggling. Therefore, there is a possibility that the easy money policy will continue for a few more years. However, the bond market believes that the Fed will change its mind soon.

For one, the unemployment rate dropped to 6.0% and there is a possibility it will end the year at 4.0% or below. And consumer prices rose by 1.7% in February and possibly by more than 2% in March. The benchmark 10-year bond yield is close to the 16-month high of 1.76%.

The GBP/USD is also reacting to the ongoing recovery in the UK, where the government is preparing for the eventual reopening later this month. This is after it has made substantial progress in vaccinations in the past few months where it has inoculated more than 30 million people.

The reopening will be a good thing for businesses, especially those in the services sector that have struggled lately. This was evidenced by the strong Services PMI numbers published yesterday. Still, a key point of concern is the vaccine passports that have been proposed by Boris Johnson.

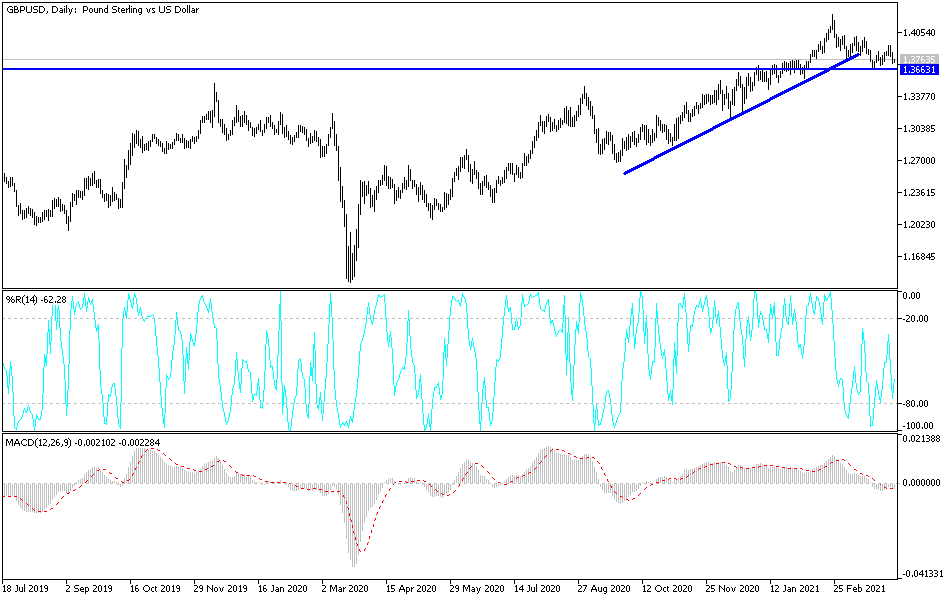

GBP/USD Technical Forecast

The three-hour chart shows that the GBP/USD price has dropped substantially in the past few hours. It has moved from this week’s high of 1.3917 to 1.3720. On the three-hour chart, the price has also moved below the short and medium-term moving averages (MA) and the important support at 1.3800, which was the lowest level on March 16. It is also at the first support of the standard pivot point. Therefore, the pair may keep falling as bears target the second support at 1.3650. However, a move above the now-resistance at 1.3800 will invalidate this prediction.