Bullish View

Buy the GBP/USD pair and set a take-profit at 1.3950 (R2 of standard pivots).

Add a stop-loss at 1.3845 (March 29 high).

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.3845 and a take-profit at 1.3745 (S1 of standard pivots).

Add a stop-loss at 1.3900.

The GBP/USD is hovering near the highest level since March 19 as investors remain optimistic that the UK economy will have a swift recovery. It is trading at 1.3891, which is 1.65% above the lowest level in March.

UK Economic Recovery

The market is optimistic that the UK economy will rebound faster because of the recent progress made by the government on vaccines. The country has already vaccinated more than 47% of its population, second only to Israel, which has vaccinated 58%. The US has vaccinated 32% while the European Union is below 15%.

Therefore, according to Boris Johnson, the country will mostly be reopened later this month. The government will accelerate the vaccine rollout and put more emphasis on testing in a bid to slow the spread. As such, the UK economy will likely recover faster than that of its comparable countries.

Indeed, on Thursday, data by Markit revealed that the Manufacturing PMI rose from 55.1 in February to 58.9 in March. On Wednesday, the organization will publish the latest Service PMI numbers. Analysts expect the data to show that the PMI rose to 57 as more service companies reopened.

The GBP/USD is also steady because of the performance of the US dollar. The US Dollar Index has risen by 0.10% as the US bond yields retreat. After rising to 0.72% yesterday, the 10-year bond yield has dropped to 1.69% while the 30-year has fallen to 2.335%.

Still, analysts believe that the yield will keep rising as the US economy rebounds. Last week, data by the government revealed that the economy added more than 900k jobs in March while the unemployment rate retreated to 6.0%. And yesterday, the Institute of Supply Management (ISM) showed that the Non-Manufacturing PMI rose to 63.7 in March from the previous 55.3.

GBP/USD Signal

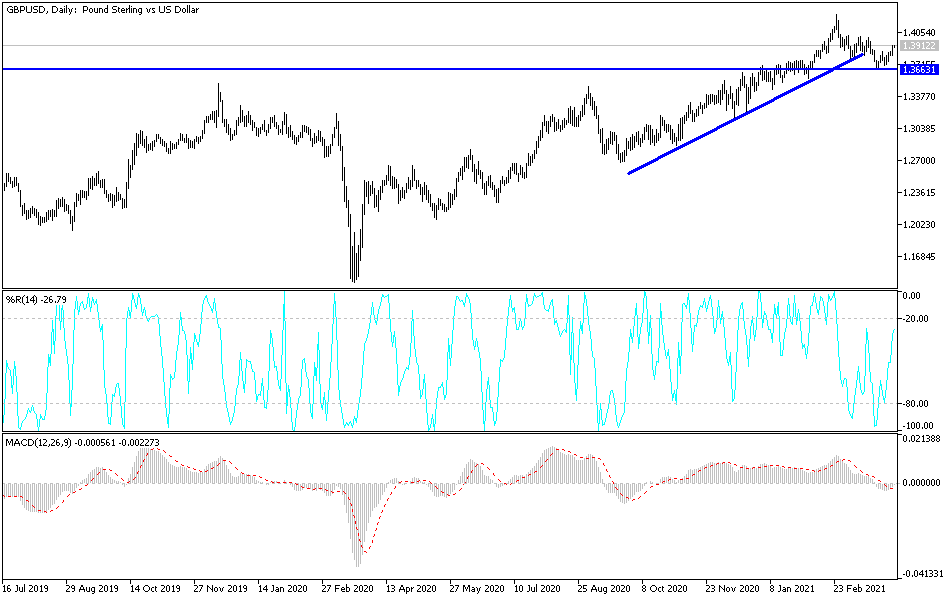

The GBP/USD pair has been on an upward trend lately. It has moved from the March low of 1.3670 to 1.3917. During this time, it has risen to the 50% Fibonacci retracement level and moved above the first resistance level of standard pivot points. It has also risen above the 25-day and 15-day exponential moving averages.

Therefore, the pair will keep rising as bulls target the second resistance at 1.3950. This price is slightly below the 38.2% retracement. However, a drop below the 61.8% retracement at 1.3820 will invalidate the bullish case.