The GBP/USD has made a bearish correction for two days in a row with losses that reached the 1.3785 support level, where the pair is stable as of this writing. The move comes after a strong rally in recent trading sessions, which culminated in a test of the 1.3915 resistance level. The falls in the value of the pound come amid a dearth of economic data in the UK this week, and Forex commentators have failed to identify a clear driver of declines, suggesting that the weak performance needs to become more entrenched before the driver becomes apparent. However, 2021 saw the pound advance against most of the other major global currencies, and the trend means that most technical analysts continue to favor further gains from the pound, as declines against the majority of the G10 currencies are still seen as a tactical buying opportunity.

Analysts at Barclays Bank - the British investment bank and the main lender - are betting this week on another sterling rally as they see that recent economic data in the UK were above expectations and economic outlook continues to improve amid the gradual easing of restrictions linked to the epidemic. The risks associated with reopening the economy must be mitigated through good vaccination efforts. Accordingly, expectations of improved economic performance in the United Kingdom significantly contrast with the Eurozone, as most countries tighten restrictions due to the high number of infections.

Yesterday, the International Monetary Fund released its latest economic forecast that shows that they now expect the British economy to grow faster than its counterpart in the United States and the Eurozone in 2022, with growth of 5.3% in 2021 and 5.1% next year. The International Monetary Fund added that growth in the UK would be 0.8 percentage points greater this year as it declared that the way out of the economic crisis was "increasingly visible".

The International Monetary Fund also raised its forecast for US economic growth by 0.8 percentage points in 2021 to 5.1% and 0.5% in 2022 to 3.6%. But expectations showed that the Eurozone will continue to lag behind with a 0.2% upgrade in both 2021 and 2022, raising the projected growth to 4.4% and 3.8%, respectively.

Last week, France entered another major lockdown while Italy extended an existing one, and at the same time it appears that the likelihood of similar measures in Germany has increased. The German newspaper Bild reported that Chancellor Angela Merkel's government has become dissatisfied with the regional approach to the extent that it wants a massive nationwide lockdown to curb the rising infection rates.

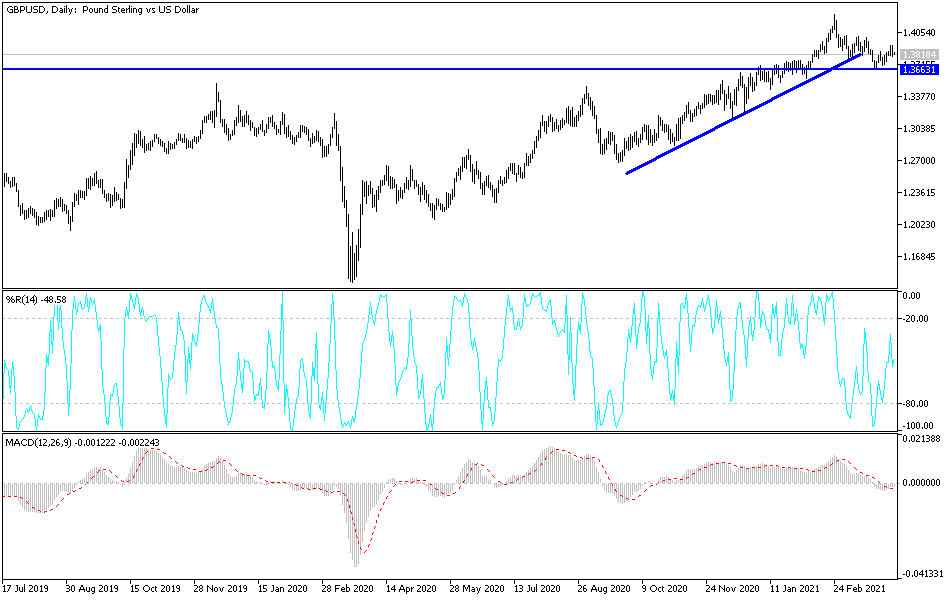

Technical analysis of the pair:

Any decline in the GBP/USD pair will be a good opportunity to consider buying again, and the pair's closest support levels are 1.3725, 1.3655 and 1.3580. On the upside, the psychological resistance at 1.4000 will remain the most important target to cause a change in the general trend. The British progress in vaccinations and easing of restrictions will accelerate the pace of the economic recovery that the world awaits, and therefore the reaction will be strongly positive on the performance of the pound sterling against the rest of the other major currencies.

The British Services PMI reading will be announced. From the United States of America, the balance of trade numbers and the contents of the minutes of the last meeting of the US Federal Reserve will be announced.