Although optimism remains about the distinctive British vaccination against the Corona virus and the implementation of the timetable for abandoning the restrictions, the GBP / USD currency pair still faces obstacles in completing the upward correction successfully. It kicked off at the beginning of this week's trading, to the level of 1.3776, before settling around 1.3740 at the time of writing the analysis, awaiting stronger stimuli. Given its role in working on the vaccination program in the UK, dissipating uncertainty about the viability of the Astrazeneca vaccine has led some observers and investors to infer risks to the expectations of analysts and economists who are looking for the UK to lead the recovery category in 2021.

Despite the losses, forex analysts at International Financial Services Provider, Westpac say the weakness of the British currency is likely to remain short-lived. Imre Speizer of Westpac says "Sterling drops should be short lived." The analysts believe that the reasons for the sterling's recent weakness are due to the heavy buying of the pound sterling with the approach of April, which made it vulnerable to changing the situation. In addition to fears of a slowdown in the vaccination program in the United Kingdom and also fears that the Scottish elections in May will bring about the "great majority" of independence.

The analysts believe that the introduction of the vaccine in the United Kingdom has been more successful than that of most other countries, while pointing to the University College London (UCL) model that predicts that the UK will exceed the herd immunity threshold early, which could allow for restrictions on activity. It ends earlier. In addition, activity surveys for the month of March were strong, indicating an increase in consumer-driven activity and investment in the middle of the year. Markit's manufacturing PMI rose to its highest level in 10 years, and services PMI rose above the 50 level, which indicates growth..

On the US side, the economic stimulus to confront the effects of the pandemic on the part of the US administration continues with strength and the efforts for vaccination are much better than in the era of Trump. The administration of Joe Biden wants a strong and rapid recovery from the effects of the pandemic. Those plans pushed the U.S. government budget deficit to an all-time high of $ 1.7 trillion for the first six months of the budget year, nearly double the previous record, as another round of economic support checks added billions of dollars to spending last month.

Accordingly, the Treasury Department said in its monthly budget report that the deficit in the first half of the budget year - from October to March - increased from a deficit of $ 743.5 billion in the same period last year.

The deficit was driven by trillions of dollars in support approved by Congress in successive economic rescue packages since the pandemic broke out in early March 2020. The latest round came in a $ 1.9 trillion measure that President Joe Biden pushed through Congress last month.

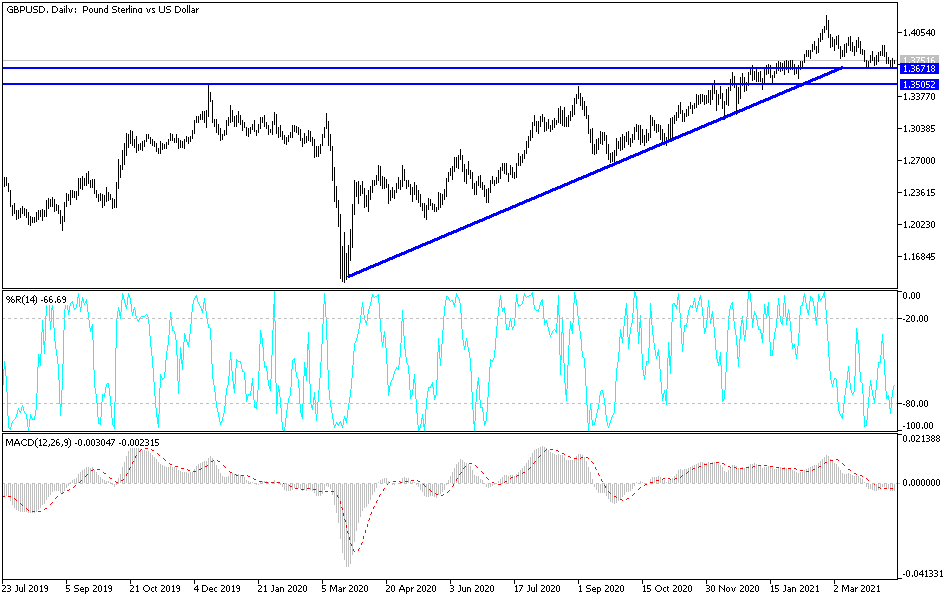

According to the technical analysis of the pair: On the daily timeframe chart, there is neutrality in the performance of the GBP / USD currency pair, with a bearish bias as long as it is on the cusp of the support level 1.3700, which I see as an opportunity to consider buying the currency pair. The bullish correction will not be strong without moving to breach the psychological resistance 1.4000 again. The pound will interact a lot today with the announcement of the growth rate of the British economy, the rate of industrial production, as well as a batch of British economic data. Then, the currency pair will be on a date with the announcement of the inflation reading in the United States of America through the CPI.