The GBP/USD pair corrected upwards to the level of 1.3911, where it settled near at the beginning of Tuesday's trading, which now has bulls eyeing the 1.4000 psychological resistance again. We have always advised to buy the currency pair from every downward level as the British advance in the pace of vaccinations and the reopening the British economy will support strong gains for the pound against the rest of the other major currencies, even with better-than-expected US economic data.

The British government announced at the start of this week's trading that all adults and children will be able to take routine COVID tests twice a week as a way to eliminate the new outbreak of the disease. The tests are being introduced as Prime Minister Johnson announces the next steps in the country's roadmap to exit the three-month lockdown.

Britain has recorded nearly 127,000 deaths from the coronavirus, the highest toll in Europe. But cases and deaths have declined sharply during the lockdown and since the start of the vaccination campaign, which has so far given the first dose to more than 31 million people, or 6 out of every 10 adults. Britain had already vaccinated all of the most vulnerable groups by Monday, and was on track to provide all adults over the age of 50 with the first dose of the vaccine by mid-April, with all adults expected to follow by July.

Yesterday's price movement represents a positive start to the week for risk currencies despite the fact that the currency movement comes amid public holidays in North America and Europe due to the Easter holiday as well as a public holiday in China for the Qingming Festival, and therefore it seems that the British pound decisively reflects its decline in March at the beginning of the week. There are calm economic data expected on both sides of the Atlantic, with the US Federal Reserve's last meeting minutes to be released on Wednesday and the Bank of England's quarterly newsletter on Friday.

Tuesday's performance will see European investors respond to the latest March non-farm payrolls report, which surpassed economists’ expectations but came strongly in the wake of the International Monetary Fund (IMF) data showing the dollar’s share in the global foreign exchange reserve basket. It reached its lowest level since 1995 in the last quarter of 2020.

The US dollar, on its part, rose against all major currencies except the Canadian dollar and the Norwegian krone last month as investors responded to an aggressive vaccination program showing that all adult Americans may receive an initial dose by the end of May. The pace of vaccinations and the increase in American financial support for families is a boon to the United States and the global economy, as well as the dollar.

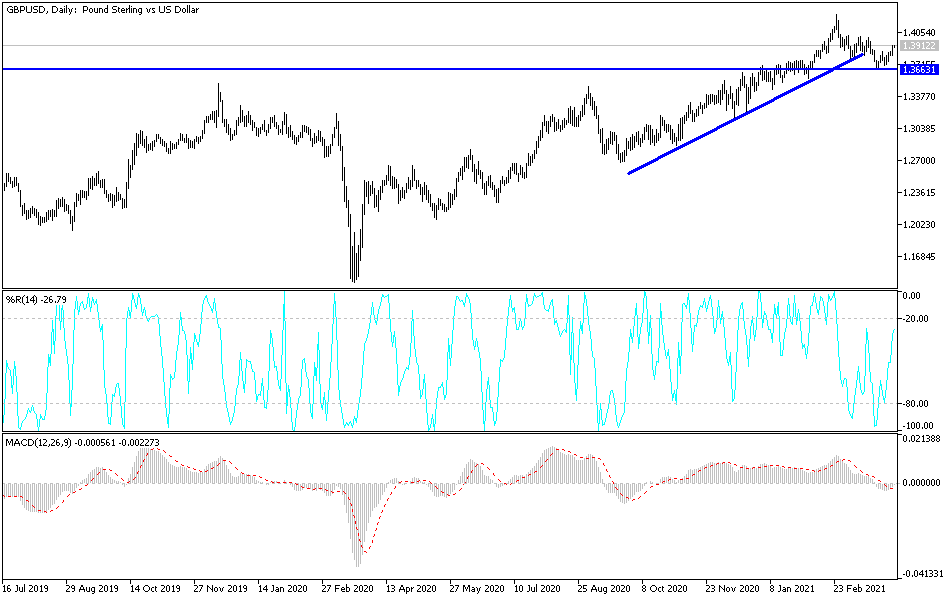

Technical analysis of the pair:

On the four-hour chart, a bullish channel has formed for the GBP/USD. The bulls' control over the performance will be strengthened in the event that the currency pair breaks through the psychological resistance of 1.4000, which may increase buying. There will likely be tronger bullishness supported by the above factors, and the bears will not control of the performance again without moving below the support level of 1.3800. I still prefer to buy the currency pair from every downside.

More risk appetite and global stock market gains will be additional support factors for further gains for the pound. The currency pair is not anticipating any important economic data from the United States and Britain. Investor sentiment will influence the direction of the currency pair today.