The GBP/USD bounced back to the 1.4000 psychological resistance level before settling around the 1.3910 support level as of this writing. The pair is exploiting the decline of the US dollar and remaining optimistic about a strong British economic recovery due to a strong vaccination campaign. Forex traders are currently interacting with the British economic numbers that followed the country's easing of restrictions. The announcement of the UK unemployment rate unexpectedly decreased to 4.9% in February, down from 5.0% in January, against expectations of a 5.1% increase.

The country's statistics office also said that the numbers indicate that the labor market has been "broadly stable" in recent months, following the severe shock of Spring 2020. In fact, there are still 800,000 fewer employees than there were before the outbreak. In the three months to February, employment fell by 73K, but that was much lower than the -147K reported in the three months to January and less than the -150K that the market was looking for.

Commenting on the numbers, Samuel Toombs, chief economist in the United Kingdom at Pantheon Macro Economics, said: “The labor market withstood a good shutdown in the first quarter and should be in better shape by the summer. The extension of the holiday scheme to the end of September eliminated layoffs, which fell on a three-month average in February to their lowest level. Troubled firms have no incentive to fire workers, at least until July. By July, employers will be required to start contributing to the cost of the vacation scheme.”

Average wages, including bonuses, rose 4.5% in February, down from the 4.8% recorded in January and the 4.8% the market had expected. The wage growth figure remains an intriguing issue in the pandemic dataset; but it must be emphasized that the growth is partly driven by synthetic effects driven by a reduction in the number and proportion of lower-paid employee jobs and increased bonuses.

Total hours worked continued to increase from low levels in the previous quarter, although the increase has stalled, according to the Office for National Statistics. The number of vacancies from December 2020 to February 2021 decreased by 26.8% from a year ago. However, the more timely data on job listings is reported to show a marked increase in job availability as the economy opens again.

Job vacancies rose last week as the economy came back to life with the partial reopening of the retail and hospitality sectors.

Fouad Razzaq Zadeh, a market analyst at ThinkMarkets.com, says that “deflationary trade” is maintaining the support of the pound. The pound came back to life again over the past two days, climbing nearly 300 pips from Friday's low, to climb above the 1.40 psychological top again. Expectations continue to grow that sterling and UK value stocks will benefit from the post-pandemic rally in growth and inflation.

Investors have warned of UK assets due to the nation's critical actions on the COVID vaccination program and infection management as daily rates and deaths continue to fall. The government's massive fiscal spending programs have also helped offset the economic damage of the epidemic while creating many jobs due to the vacation scheme and other government measures.

All this means that with the shutdown measures slowly lifted, pent-up demand should help fuel a strong economic recovery, as investors no longer have to worry about the Brexit uncertainty that has affected sentiment over the past several years. These expectations are the reasons why investors continue to buy short-term declines in both the British pound and the UK stock market.

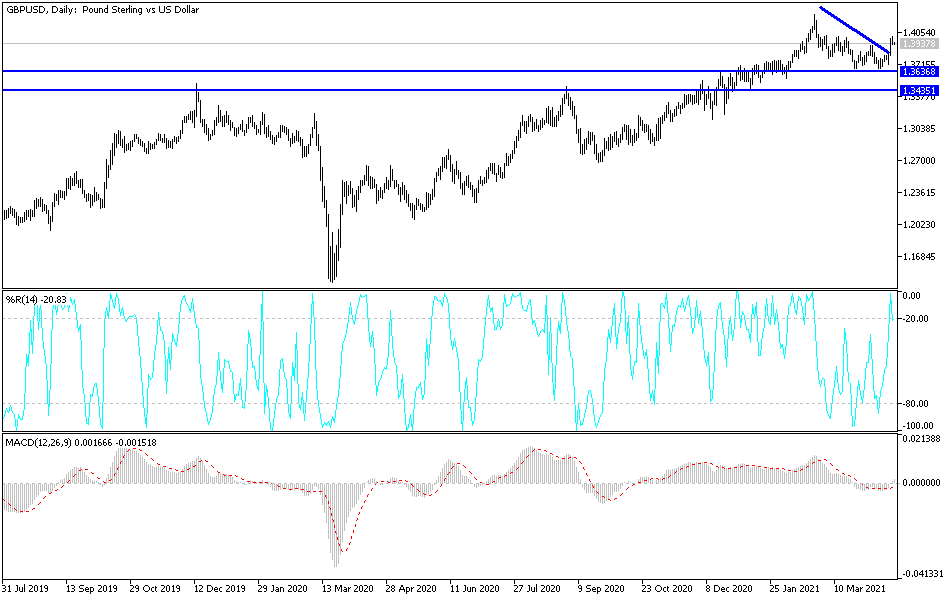

Technical analysis of the pair:

As I mentioned before, the psychological resistance of 1.4000 will remain crucial for the bulls to retain control over the pair's performance in the coming days, as stability above it will see buyers move the pair to the top of 1.4242 in a short time. On the downside, 1.3735 will be the most important support level for the bears to regain control of the performance again. I still prefer to buy the sterling dollar on every downside.

Today, the British pound will react to the release of British inflation figures and the comments of the Bank of England monetary policy officials. There is no significant US economic data expected.