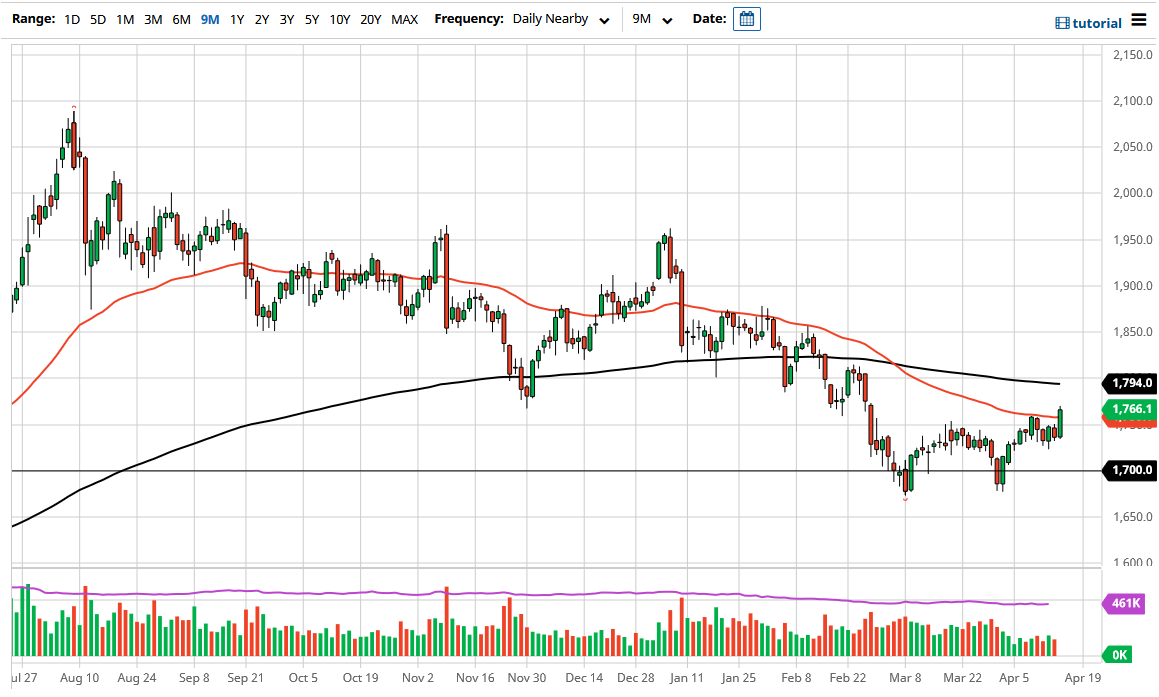

Gold markets have broken significantly to the upside during the trading session on Thursday to break above the 50 day EMA and clear the $1750 level. This is an area that should continue to be paid close attention to as the 50 day EMA does tend to attract a lot of attention. The question now is whether or not we can continue to go higher?

If we break above the top of the candlestick for the session on Thursday, then I think it is very likely that we will see this market continue to go towards the 200 day EMA, perhaps with the idea of testing the $1800 level. Breaking above that level of course would be a very bullish thing indeed, sending the market towards the $1850 level, followed by $1950. In fact, I would look at it as a complete change of trend, and therefore would expect gold to go much higher over the longer term.

On the other hand, if we were to break down below the $1750 level, we will test the $1730 level next, which is an area that continues to be important based upon the recent support. Breaking down below there then opens up the possibility of testing the micro double bottom down near the $1675 level. Breaking down below that level then could very well send this market much lower, perhaps reaching towards the $1500 level.

The market participants will continue to pay close attention to the bond yields in the United States, which could have a major influence on what happens with gold as they had recently. Rising yields are toxic for gold, and that of course is something that needs to be paid close attention to, but it certainly looks as if the market is likely to struggle to keep up massive amounts of momentum as the US dollar is starting to get a bit oversold against most currencies. Because of this, you will need to be cautious and probably scale into positions instead of jumping “all in.” If you do jump into positions in one big move, you could find yourself been slapped around by the volatility that this market can show at times. Position sizing will be crucial, because if we are starting to see a major change in the direction of this market, you should have plenty of time to and if it from a longer-term move to the upside.