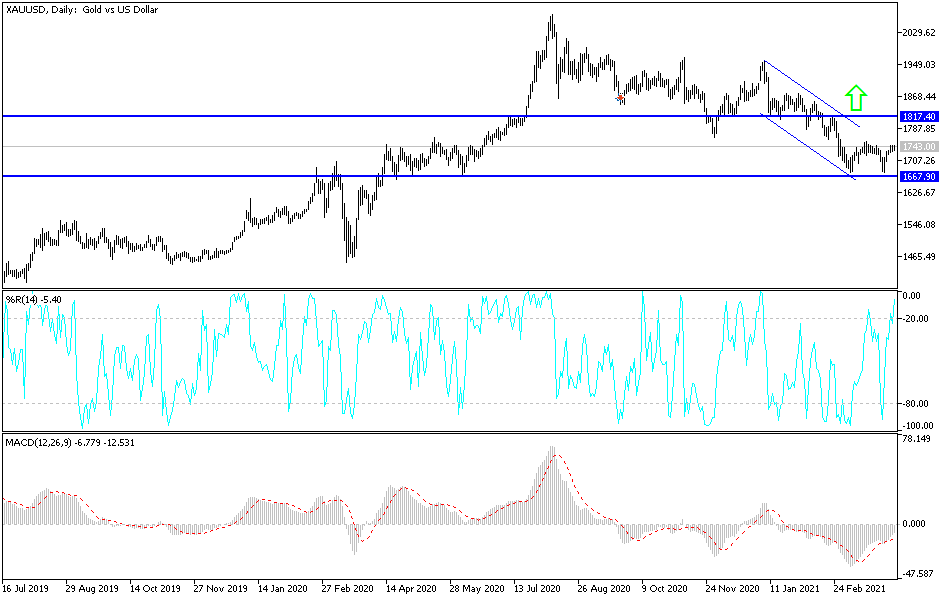

The gold markets initially had pulled back a bit during the trading session on Wednesday but then turned around to show signs of strength again. The candlestick is a bit of a hammer, so if we were to break above the $1750 level it is likely that we could turn around and go towards the upside. The 200-day EMA above sits at the $1800 level roughly, and I think that could be your target eventually. This is assuming that we break above the $1750 level on a daily close.

If we do not, it is likely that we could see a bit of a pullback, and that could turn the candlestick on Wednesday into a “hanging man.” That is a very bearish candlestick formation and could open up the possibility of a move back down below the $1700 level. However, gold certainly looks as if it is trying to find its way higher, and US yields have been dropping on the whole, which helps the idea of gold rallying.

Recently, the correlation between yields rising and gold falling has been extraordinarily strong, so it would not be surprising at all to see that continue. However, if we do see the US dollar drop a bit and those yields dropped, that could give us reason enough to see gold break out. Once it does, the “micro double bottom” that just formed could be worth paying close attention to as it may be a major turnaround signal. The 50-day EMA just above will have a little bit to say, but at the end of the day it gets sliced through occasionally, so I only put so much credence into it.

Ultimately, the fate of gold is in the hands of the bond market, which is something that you should be paying close attention to. At this point, it should be noted that silver looks as if it is a bit stronger than gold, and it should be because of the industrial demand for it. That does not mean that gold cannot rally, just that you may see a little bit more in the way of alpha over in that market. Nonetheless, the key here is going to be the $1750 level.