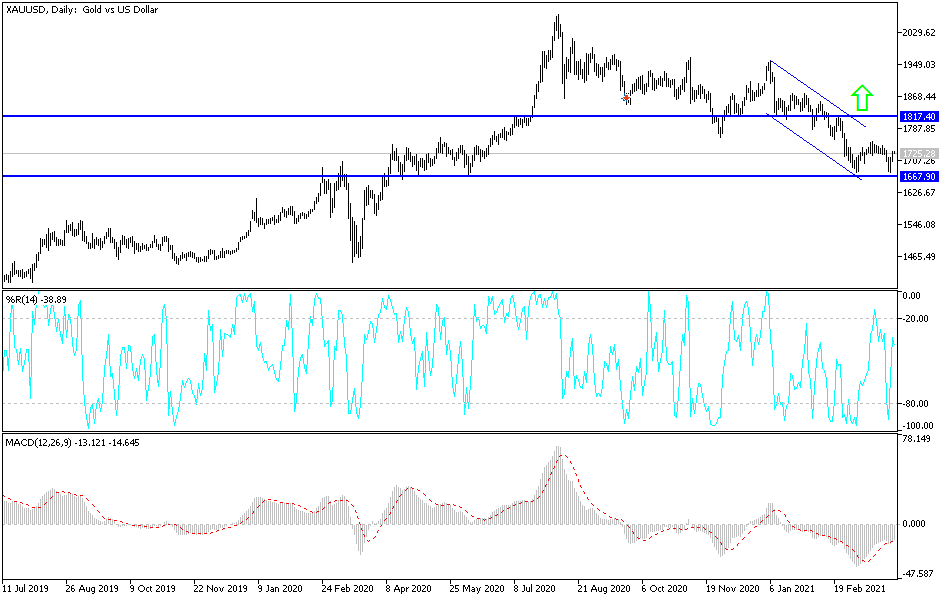

The futures markets were closed for Good Friday, with the exception of very shortened Globex trading off-hours. Having said that, the gold markets have recently formed a little bit of a “double bottom”, and that could be the beginning of something rather interesting. It is also worth noting that the weekly candlestick is a hammer, so that bodes fairly well for gold as well.

However, one of the biggest problems that we have right now is the yields in America taking off to the upside. After all, the 10-year yield rallied about 3.6 basis points during the session on Good Friday, which gold markets did not really have a chance to react to. It will be interesting to see how this plays out, but I think if we break down below the double bottom underneath, it is very likely that gold will continue to crash much lower, perhaps reaching down towards the $1500 level. The $1500 level is a large, round, psychologically significant figure, and it will attract a lot of attention not only due to that but the fact that it has been important in the past.

On the other hand, if we turn around and break above the $1750 level, then it is likely that the market could go looking towards the $1800 level. The $1800 level also features the 200-day EMA, so that in and of itself will attract a lot of attention. I think we are about to see a bigger move given enough time, so I think that we have a nice trade setting up one way or the other. I think it also comes down to inflation expectations in the United States, and what happens in the bond market. After all, if the bond market continues to offer a way to clip coupons, the higher it goes instead of paying for storage. The biggest problem gold has right now is that the bond markets continue to offer a real rate of return. If yields continue to rise, that is only going to exacerbate this entire situation. On the other hand, if we see yields start to drop again, that could be good for gold and send it higher. In the meantime, keep an eye on the 10-year yields and the US dollar.