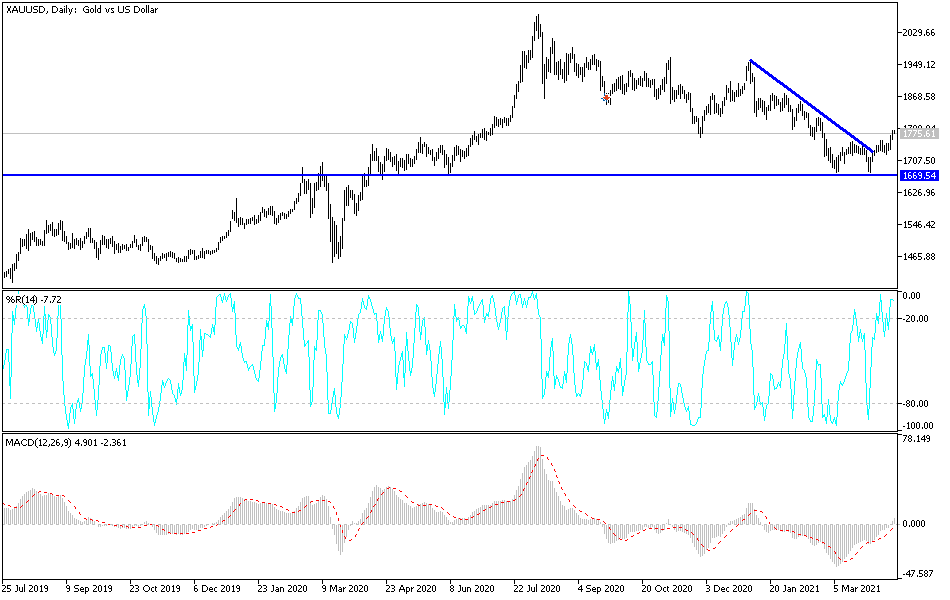

The gold markets rallied a bit during the trading session on Friday as we reached towards the $1780 level. That is an area that could cause extreme resistance, extending to the 200-day EMA. If we were to break above the 200-day EMA, then it is possible that we could see a bigger move to the upside. At that point in time, it is likely that the $1850 level could be a target, possibly followed by the $1950 level.

That being said, the market is likely to continue to hear a lot of noise even if we do break out to the upside, and it would almost certainly have to pay attention to the US dollar, as the counter-cyclical nature of these two markets should be watched. With that in mind, I think that it is only a matter of time before the bond market has its say when it comes to the value of the greenback and, by extension, the value of gold markets. Gold is looking a little bit more attractive as yields in America have stabilized a bit, so we do not necessarily have a lot of concerns when it comes to that end, at least not recently. If the yields in America can continue to stabilize a bit, that should be a good opportunity for gold to continue to go higher.

To the downside, the $1750 level would be supportive, but if we break down below that area, then it is likely that we could go down towards that small double bottom underneath. With that being the case, the market is likely to break down at that point and then perhaps go looking towards the $1500 level underneath. The $1500 level is a large, round, psychologically significant figure, and it could attract a certain amount of attention. I would also point out that if we break down below the double bottom underneath, it is likely that we would see the move accelerate to the downside, perhaps as it can be thought of as a “trapdoor opening” underneath. It is likely that we will continue to see volatility, but then it is likely that we could see longer-term moves realized. Jumping “all in” could be very dangerous at this point.