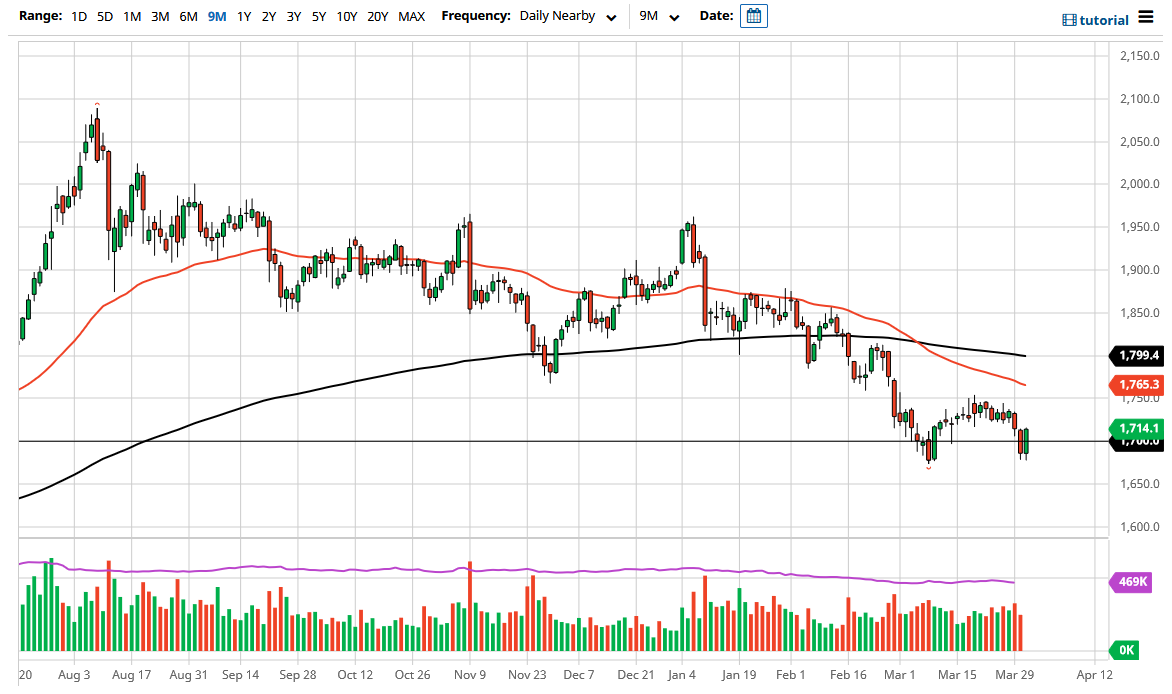

Gold markets have rallied significantly during the trading session on Wednesday to see the market vaults above the $1700 level. That being said, the market is still very bearish, and therefore I think at this point in time we need to see some type of major shift in the attitude of markets overall to see the gold markets rally for any significant amount of time. The $1700 level of course is a large, round, psychologically significant figure that a lot of people would be paying close attention to it, but if we break down below the lows that we just made, that could drive gold to all the way down to the $1500 level.

On the other hand, if we clear the $1750 level, then we will test the 50 day EMA, which could send this market towards the $1800 level. The $1800 level features the 200 day EMA, and of course is a large psychologically important figure. If we break above there, then I would be convinced that we are completely turning the overall trend around, but I do not see that happening anytime soon. We would need to see yields completely fall apart in the 10 year note, something that does not look very likely to happen.

I do think that the one thing that we are going to see is a lot of is going to be volatility in choppiness, but at the end of the day until rates start dropping, gold is not very attractive due to the fact that you can simply clip coupons in the bond market instead of paying to store gold, which is quite expensive. As long as there is a real yield in the bond markets, there is no reason to think that gold rallied for any significant amount of time.

All of that being said, I do believe that this is a market that will probably spend some time in this general vicinity, but if we can break above the 1.8% level in the 10 year note, that will kick off the massive selling that I expect to see in the gold market. To the upside, if we were to break down below the 1.5% yield in the 10 year note, then I think that is when gold really starts to turn things around.