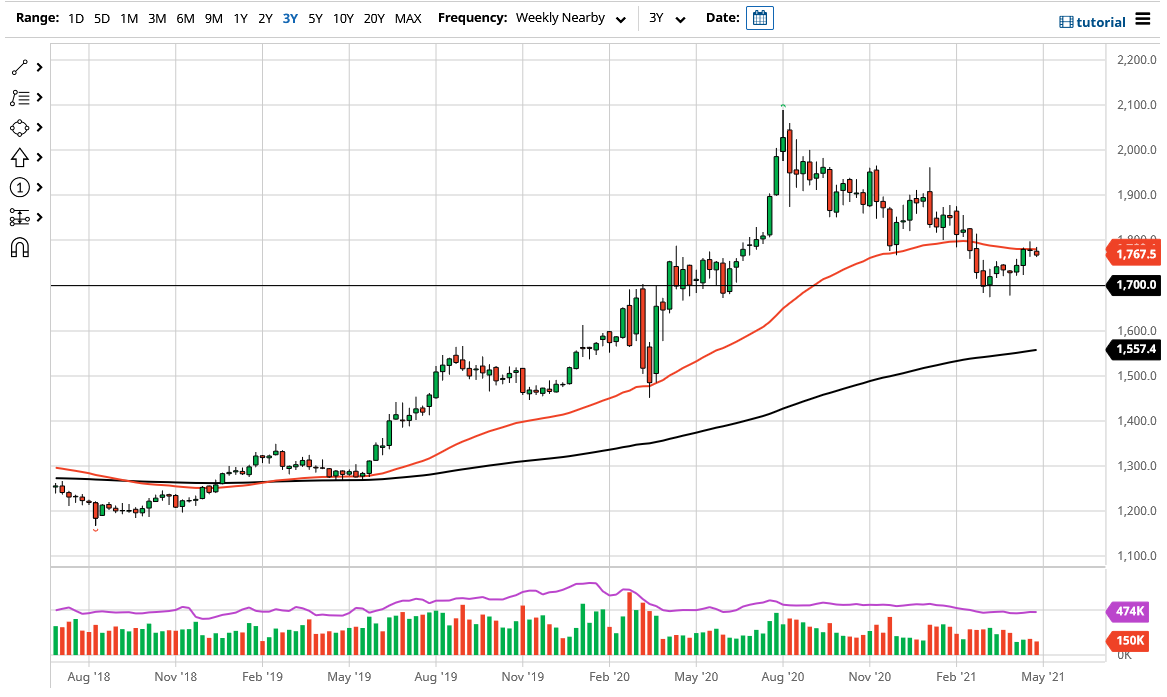

Gold markets have had a positive month for April, but it must be pointed out that gold has bounced from a large, round, psychologically significant figure in the form of $1700, and that it is finishing the month struggling with the 50-week EMA. It is because of this, and the fact that the 50-day EMA is starting to tilt a little bit lower, that I think the selling pressure is about to pick back up.

One of the biggest problems for gold has right now is the fact that the bond yields in America are keeping up with inflation expectations, meaning that there is a “real rate of return” by clipping coupons in the bond market instead of paying for storage to keep gold. While most retail traders do not have that issue, the big money does, and the big money will buy or sell the market.

Furthermore, one has to make the argument that perhaps cryptocurrencies have taken some of the inflows that metals may have had in the past away from the gold market. After all, a lot of people are using Bitcoin as a replacement for gold, and although I do not think that it replaces it 100%, there are enough people out there that are willing to jump into that market based upon gains that it certainly has put a bit of a dent in this market.

From a technical analysis standpoint, if we can close above the $1800 level on a weekly candlestick, then I might be convinced that the market could go looking towards the $1900 level during the month. That being said, the most likely of outcomes this month is a simple consolidation with a downward bias. The $1675 level has been very significant support multiple times, but most importantly, just a little over a month ago. If we can break down below that little “double bottom”, this market has further to go, perhaps reaching towards the $1500 level on the longer-term charts.

As far as the month of May is concerned, I suspect that you will spend most of this month shorting gold on signs of exhaustion. This will be especially true if the US dollar starts to get a bid again, which will be a bit of a “double whammy” against the idea of owning gold, so I believe that gold has a lot of work to do to change people’s minds still.