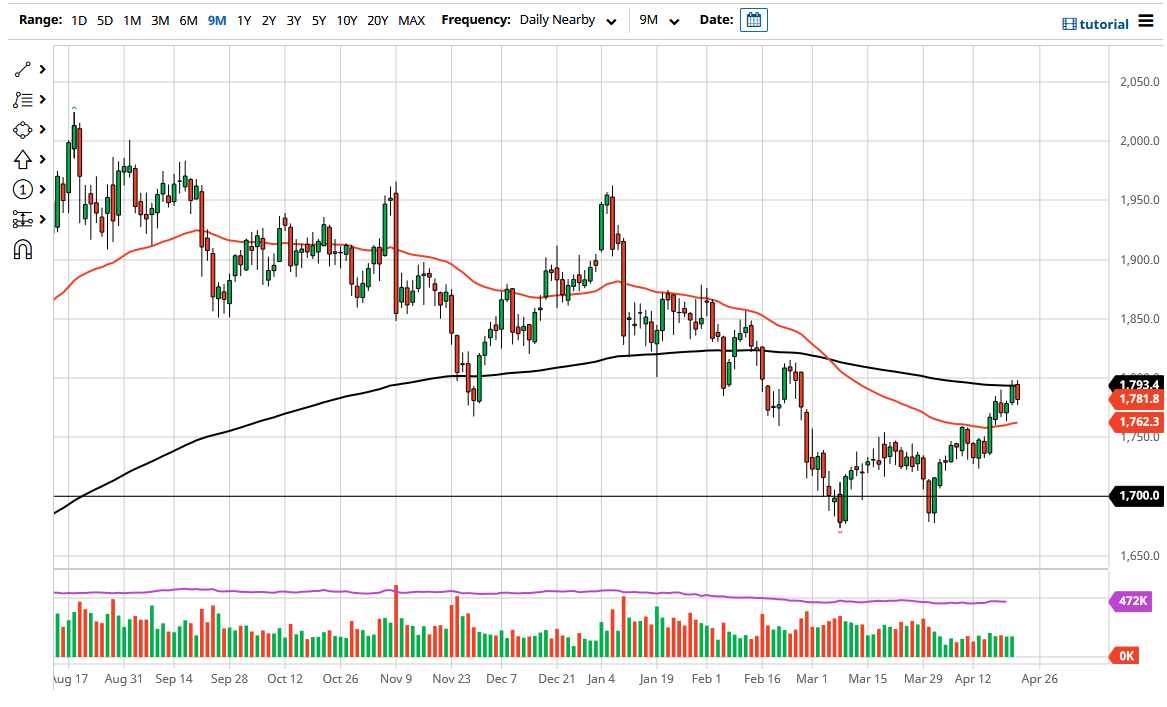

The gold markets initially tried to break out above the 200 day EMA during the trading session on Thursday but gave back the gains to show the 200 day EMA to be rather resilient. If that holds true, then we could very well find this market reaching back towards the 50 day EMA. It is also worth noting that the $1800 level is sitting just above, so that may have caused a little bit of trouble as well. With that being the case, the market is likely to see a lot of noise in general, because we are trading between the 50 day EMA on the bottom and the 200 day EMA on the top.

That area is essentially a “squeeze” that could cause some issues. That being said, I think that we still have a lot of questions as to where gold goes next, mainly because it comes down to US dollar moves and yields in America. While yields spike, that typically works very hard against the value of gold, and therefore it is likely that we would see the markets pullback towards the 50 day EMA, and possibly even lower. If they break down below that level, then it is likely that we go looking towards that double bottom on the chart that has been so stable so far. Breaking down below that more than likely sees the gold markets falling apart. On the other hand, if we see this market turn around and break above the 200 day EMA and more importantly the $1800 level, then things suddenly look very bullish.

On a bullish move, I anticipate that the $1850 level would be targeted rather quickly, followed by the $1950 level. After all, that could send money flowing into the precious metals market and perhaps even try to push towards the all-time highs eventually. Do not get me wrong, this will of course be influenced by yields in America as well, so you need to pay attention to whether or not they start spiking. When they do, that works against gold rather rapidly as we had seen previously. On the other hand, if yields rise gradually, then it is not as big of an issue. It is about the rate of change in the bond market more than anything else right now.