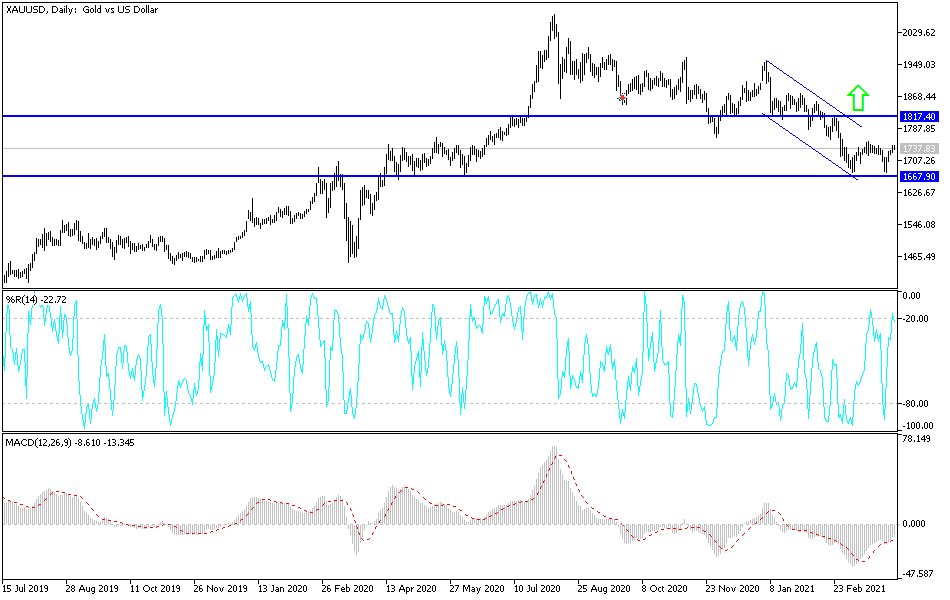

Gold markets rallied again during the trading session on Tuesday as we continue to see the US dollar slump slightly after the recent rally in yields. The market looks very likely to continue to move right along with yields, so pay close attention to that. The candlestick is closing towards the top of the range, and that typically suggests that the market is going to continue going forward. The market will also continue to see a little bit of resistance at the $1750 level, and a break above there, perhaps coupled with a fall in yields going forward, could send gold much higher.

Gold is trying to decide whether or not we have just formed a small “double bottom”, or if we have just seen a little bit of relief in what has been a massive sell-off. This is a market that I think will continue to be very noisy, but if we can break above the $1750 level, it will also be worth noting that the 50-day EMA is sitting in that same general vicinity as well. This is why I am a little bit cautious, because breaking out above there would be a significant turnaround, and probably lead to something bigger when it comes to momentum. In other words, the market will probably go much higher, meaning that we are looking at a potentially huge move, so you can take your time.

On the other hand, if we show signs of exhaustion then it is likely that we could simply drift back into the previous consolidation area, meaning that we could drop down towards the $1675 level again. That is an area that being broken to the downside will almost certainly send this market much lower, perhaps down to $1500.

The fact that we are closing at the very top of the range is a good sign, so I suspect that we should get an opportunity to start buying gold sooner rather than later. The one thing that would change everything right away would be yields spiking in the United States, which has been absolutely toxic for gold. I think the one thing you can count on is a lot of noise.