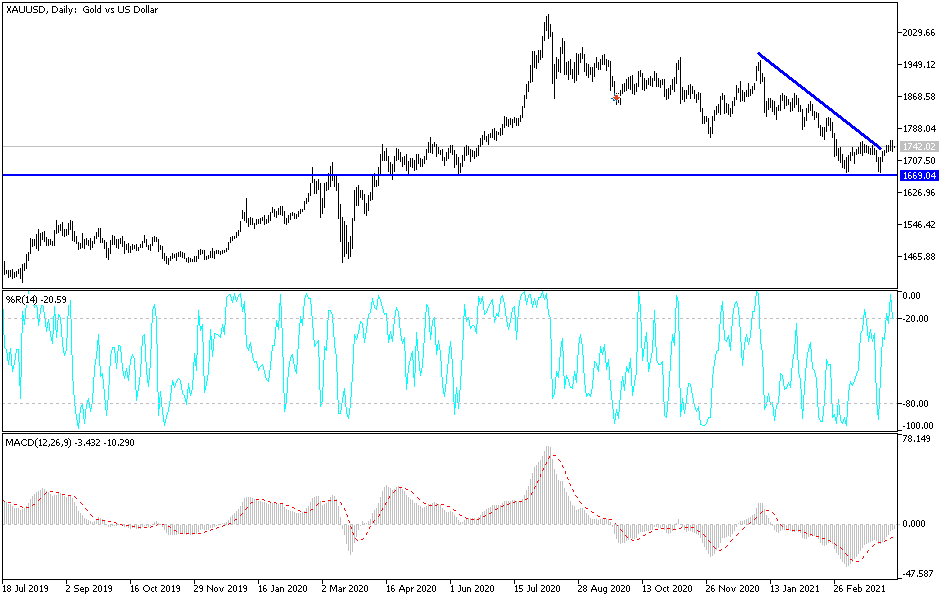

The gold markets initially fell during the trading session on Friday but then turned around to show signs of life at the bottom of the range of the candlestick from Thursday. By doing so, we ended up forming a little bit of a hammer-like candlestick, so it is possible that we have buyers that are willing to come into this market and push it higher. However, we have the 50-day EMA sitting just above and that seems to be offering a little bit of resistance. If we can break above that level, then it is likely that we could go looking towards the 200-day EMA above, which is sitting just below the $1800 level.

On the other hand, if we break down below the bottom of the last couple of candlesticks, then the market is likely to go looking towards the $1700 level. After that, we would attack the double bottom that recently just formed. If we break down below that, then gold will find itself in a significant amount of trouble. On a breakdown below those two lows, I would anticipate that this market probably would make a serious attempt to get down to the $1500 level.

Gold markets have been most certainly influenced by the interest rate situation in America, as the rates had spiked quite drastically to the upside. It had gold selling off significantly, and therefore it looks like that correlation is still something that we really need to pay attention to. Not only will it affect the value of the US dollar, but it also affects the idea of whether or not you are getting a “real rate of return” when it comes to the bond market. While that does not necessarily sound interesting to most gold traders, the reality is that if we can get a yield above inflation by simply clipping coupons, then why would we waste our time paying significant money to store gold?

While the average retail trader does not worry about these things, the real money - the big firms out there that are actually taking delivery of gold - are the people who move the markets. Just buying one contract on the futures market is nothing. But longer-term sovereign funds and pensions, etc. have to worry about these bigger issues.