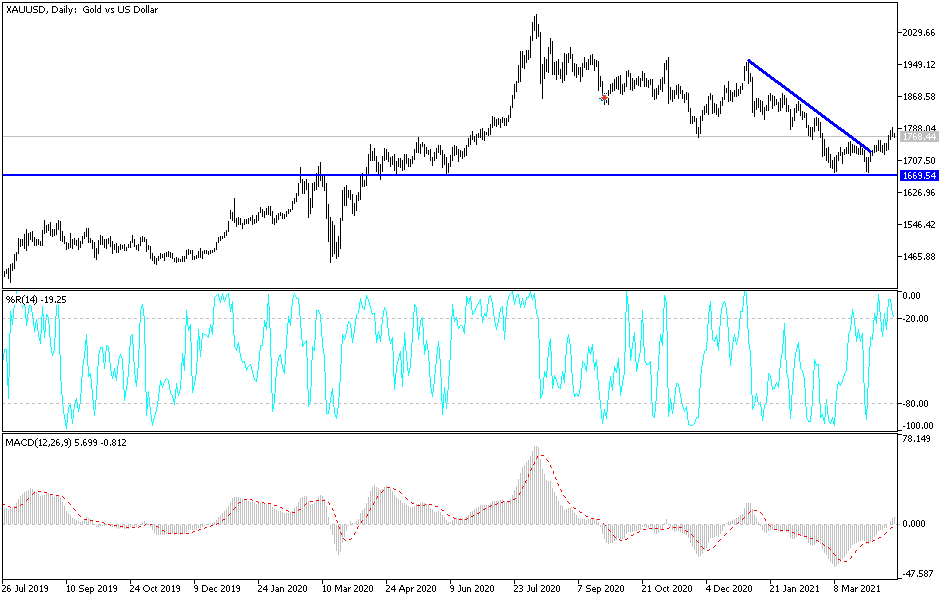

Gold markets rallied again during the trading session on Monday, but then turned around to form a less-than-enthusiastic-looking candlestick. In fact, by the time the gold pits closed, we ended up forming a bit of a shooting star, which is a negative reversal signal. If we were to break down below the bottom of the candlestick, then I think what we would see here is an attempt to break down below the $1750 level, and then possibly even threaten the double bottom near the $1700 level.

If we do get that breakdown, it could be rather quick, due to the fact that we have been very negative for quite some time, with the exception of the last few weeks. That being said, it is likely that we will continue to see somewhat of a downward push due to the overall trend. Furthermore, interest rates in America are climbing, so that puts downward pressure on gold, because it becomes more cost-effective to clip coupons and collect the yield from a bond then it does to pay for storage of gold.

I think that this market breaking above the 200-day EMA could open up a bigger move to the upside, and it could signal significant recovery for the gold market in general. That would threaten the $1800 level, which is a large, round, psychologically significant figure, and the market would pay close attention to it if we were to break above.

If we do clear the $1800 level to the upside, then it is likely that the market will go looking towards the $1850 level, followed by the $1950 level. Above there, gold would start to trend much higher, perhaps reaching towards the highs. Ultimately, this is a market that looks to be very choppy, so I do think that the most important thing you can find is some type of impulsive candlestick to get things going, as we continue to hear a lot of noise in the US dollar as well, which does not help the situation either. Looking forward, I believe that we are trying to build up enough inertia for the next move, which is still a bit of a question as to which direction we are going to go.