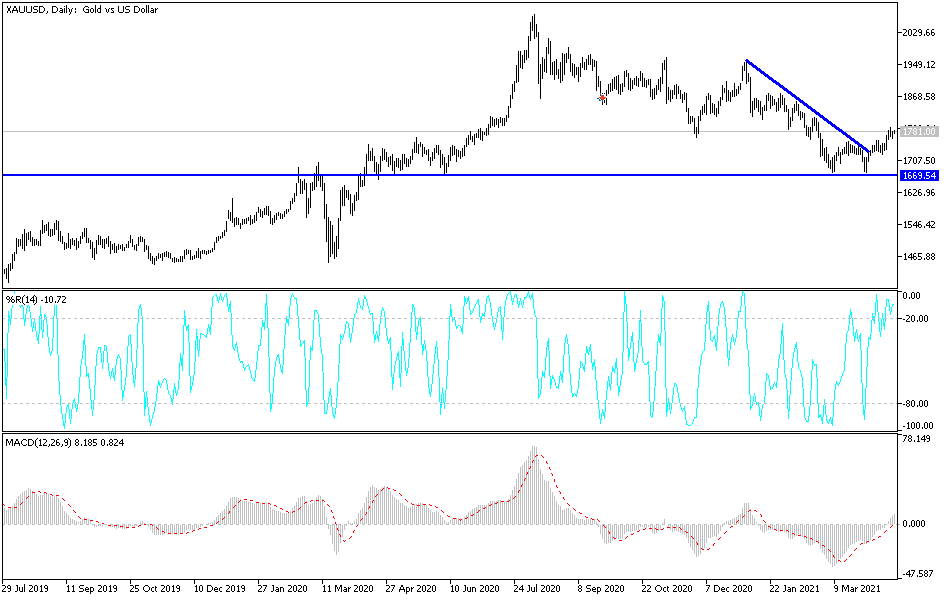

Gold markets initially pulled back a bit during the trading session on Tuesday, but it looks as if the 50-day EMA is going to continue to offer some support. We are currently between the 50-day EMA and the 200-day EMA indicators, so with that being the case it is likely that the market will continue to be very choppy. The question that we have right now is whether or not we are trying to build up a case to go higher, or if the 200-day EMA will continue to offer massive resistance.

I will be frank with you: it is not that easily seen at this point. Because of this, it is best to simply let the market do what it is going to do and follow right along. The main reason that it has become so difficult is that there is the argument for inflation pushing go higher, but at the same time, if the yields in America suddenly spike higher, we have already seen what kind of damage that can do to the gold markets.

I believe that if we break down below the 50-day EMA, we will then go looking towards the $1775 level, possibly even reaching down towards the double bottom underneath which sits below the $1700 level. If we were to break down below there, then the gold market is going to completely fall apart. Nonetheless, it is a bit difficult to envision that happening easily.

On the other hand, if we were to break above the 200-day EMA, then it is possible that we could go much higher. Again though, this does not mean that it is going to be easy to make this happen. A break above the 200-day EMA attracts a lot of people, so at that point you will probably see more money flow into the market. Breaking above the $1800 level would satisfy not only a large, round, psychologically significant figure being overtaken, but it also puts the 200-day EMA in the rearview mirror. At that point, the market will go looking towards the $1850 level, and then possibly even reaching towards the $1950 level. In the meantime, this is a market that is going to be very choppy and difficult to trade large positions in, so I would use the moving averages as indicators as to which direction to go.