The price of gold has been trying to rebound upward, but the gains of the bounce did not exceed the $1730 level, instead stabilizing around $1725 in this week's trading. The bullish momentum remains weaker with continued gains in the US dollar and the increase in US bond yields. The yellow metal is ready to rise due to the return of COVID restrictions in many global economies due to mutated strains of the epidemic, coinciding with concern about some side effects of vaccines, which is a threat to the expectations of the expected global economic recovery.

Despite the better-than-expected numbers, the US jobs report on Friday indicated some challenges ahead. The number of people who have been unemployed for six months or more - and who tend to have a particular difficulty finding a job - has increased. They now make up more than 40% of the unemployed. And the number of people who said they had lost their jobs permanently hardly decreased in March. Many of the people who found jobs last month were classified as temporarily unemployed.

But optimism is on the rise, in part because the $1,400 checks in Biden's economic relief plan have led to a sharp increase in consumer spending, according to Bank of America's tracking of its debit and credit cards. The bank said spending jumped 23% in the third week of March compared to pre-epidemic levels. As is well known, consumer spending represents 70% of the economic activity of the United States of America.

Spending began to rise in March even before the stimulus checks arrived as the numbers of coronavirus cases fell from their high levels in January. Americans are increasingly willing to venture out of the house to travel and eat out, albeit not at the pre-pandemic pace. Nearly 1.5 million people traveled through the airports on March 28.

However, the US hiring increase last month raises an important question: could it continue at the same pace? In addition to the 8.4 million fewer jobs now in the US economy compared to the pre-virus period, two million or so additional jobs could have been added last year under normal circumstances. This means that the US economy still needs more than 10 million more jobs to regain something close to full health.

Louise Shiner, a senior fellow at the Brookings Institution and a former economist at the Federal Reserve Board, estimated that the average employment could range between 700,000 and 1 million per month for the rest of the year if the economy grew at a similar rate of 6.5%. The Fed and many economists expect that this would leave the total job growth for 2021 in the range of 7 to 10 million.

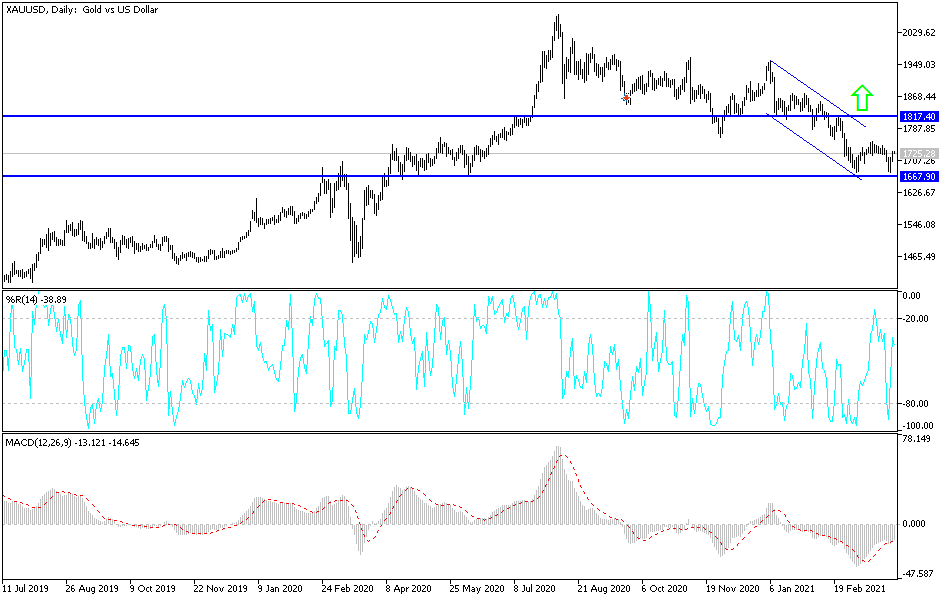

Technical analysis of gold:

The price of gold is waiting for the gains of the US dollar to stop in order to find the opportunity to launch strongly to the upside, as the factors of its gains are still present and increasing. Therefore, it is best to buy gold from each lower level, with the nearest support levels for gold being $1710, $1685 and $1660. On the upside, as I mentioned before, the bulls will regain control of performance in the event that the gold price moves towards the psychological resistance level of $1800 again.

The increase in infections and the imposition of more restrictions, especially from global economies, and the stumbling global vaccination pace will be the most prominent factors of the gold price gains in the coming period.