The price of gold is expected to continue to move in a limited range until the reaction of the dollar to the Federal Reserve’s monetary policy decisions and the statements of Chairman Jerome Powell. Since the start of trading this week, the price of gold has moved in a range between the level of $1770 and the level of $1785. In the same performance, silver futures contracts ended lower at $26,410 an ounce, while copper futures settled at $4.4880 per pound.

No major changes in monetary policy are expected from the two-day US Federal Reserve meeting ending Wednesday, and investors are likely to pay close attention to Chairman Jerome Powell's comments after the meeting.

A report showed that US consumer confidence reached its highest level since February 2020 in April. The Confidence Index jumped to 121.7 in April after rising to a revised 109.0 reading in March. Economists had expected the Consumer Confidence Index to rise to 112.0 from the 109.7 originally announced for the previous month.

US President Joe Biden signed an executive order yesterday to increase the minimum wage to $15 an hour for federal contractors, providing a wage increase for hundreds of thousands of workers. In this regard, Biden administration officials said that higher wages would increase worker productivity and offset any additional costs to taxpayers.

The White House said in a statement: "This executive order will enhance economy and efficiency in federal contracts, and provide value to taxpayers by enhancing worker productivity and generating high-quality work by enhancing workers' health, morale, and efforts." The increase could be significant for workers earning the current minimum of $10.95 an hour. These workers will receive a wage increase of 37%, although the increase will take place gradually, according to the terms of the order.

Some countries are suffering from a truly tragic situation in the face of the injuries and deaths from the epidemic, especially India. There are some other countries that have made progress in vaccinations, resorting to reopening economic activity, and the most prominent in Europe were Italy and France. In this regard, the Center for Disease Control and Prevention has relaxed its guidelines on wearing masks in the open air, saying that fully vaccinated Americans do not need to cover their faces anymore unless they are in a large crowd of strangers. Those who haven't been vaccinated can go out without a mask in some situations as well.

The new US guidelines represent another carefully calibrated step on the way back to normal from the coronavirus outbreak that has killed more than 570,000 people in the United States. For most of the past year, the CDC has been advising Americans to wear masks outdoors even if they are not within 6 feet of each other.

The change comes because more than half of adults in the United States - or about 140 million people - have received at least one dose of the vaccine, and more than a third of them have been fully vaccinated.

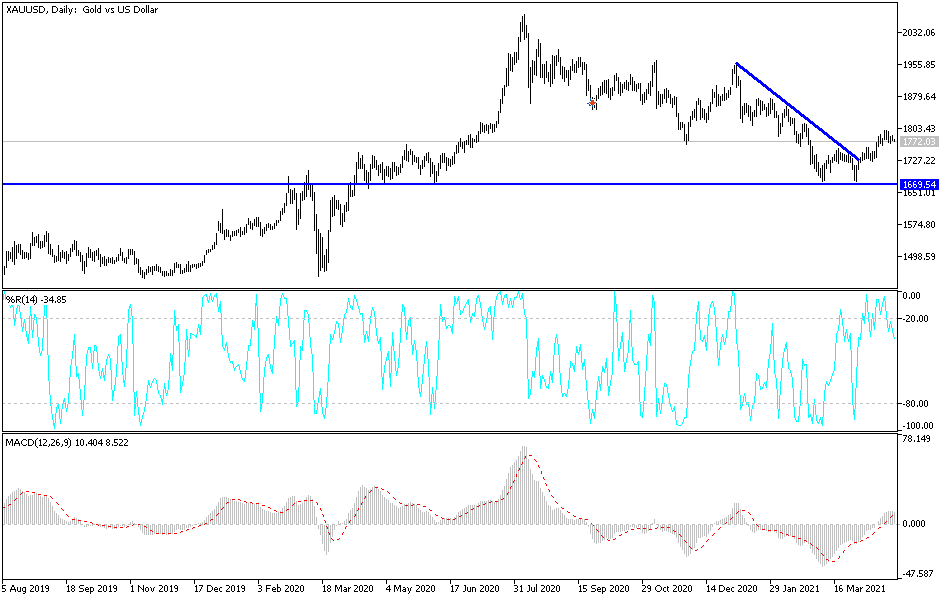

Technical analysis of gold:

The gains in the price of gold have stopped so far. Gold has not exited the range of its ascending channel, which will not happen without the price moving to the support level of $1715. It is expected that we will witness strong gold price movements today as a natural reaction to the interaction of the US dollar and the markets with the Fed's announcement of its monetary policy decisions and the statements of Chairman Jerome Powell. The bulls' control of gold's performance will increase with stability above the $1800 resistance. At the same time, it must be taken into consideration that optimism about the reopening of major economies may weaken the bullish path. So far, I still prefer to buy gold from every downside.