The price of gold declined at the end of last week’s trading from its 7-week high at about $1785 to trade at $1775, where it settled at the beginning of this week’s trading. However, the opportunity to go higher still exists and will be strengthened if the gold price breaks the psychological peak of $1800. But at the same time, this performance may be affected by the global progress in vaccinations and the easing of restrictions in some countries. This would allow global economic activity to be restored, which would negatively affect the price of gold, the most important of safe havens. Some global geopolitical tensions that are re-emerging may provide some support for gold.

Gold trading is influenced by the announcement that the preliminary US Consumer Confidence Index in Michigan for April fell below expectations of 89.6 with a reading of 86.5. On the other hand, US building permits for the month of March beat expectations of 1.75 million with a record of 1.766 million (monthly). Housing starts during the period also exceeded expectations (monthly) of 1.613 million, with a value of 1.739 million.

Prior to that, a significant increase in US retail sales for the month of March was announced, over the expected change of 6.3% with sales of 6.9%. General retail sales beat the expected change (monthly) by 5.9% with a change of 9.8%. Also, the April Fed Manufacturing Survey in Philadelphia beat expectations of 42 with a reading of 50.2, while retail sales of cars prior to March exceeded the expected (monthly) growth of 5% with a growth of 8.4%. Earlier, the US CPI excluding food and energy for March beat expectations on both the (monthly) and (annual) readings.

The US dollar, the strongest influence on the price of gold, has witnessed a difficult week. Despite a series of economic data that showed that the US economy was growing more than expected, the dollar failed to gather any momentum and fell against all major currencies and most emerging market currencies. The yield on the 10-year US Treasury note decreased by eight basis points last week, the largest number since last August, and decreased by 15 basis points over the past two weeks. The 30-year bond yield dropped just over six basis points to extend its decline for the fourth consecutive week and lift the cumulative decline to around 17 basis points.

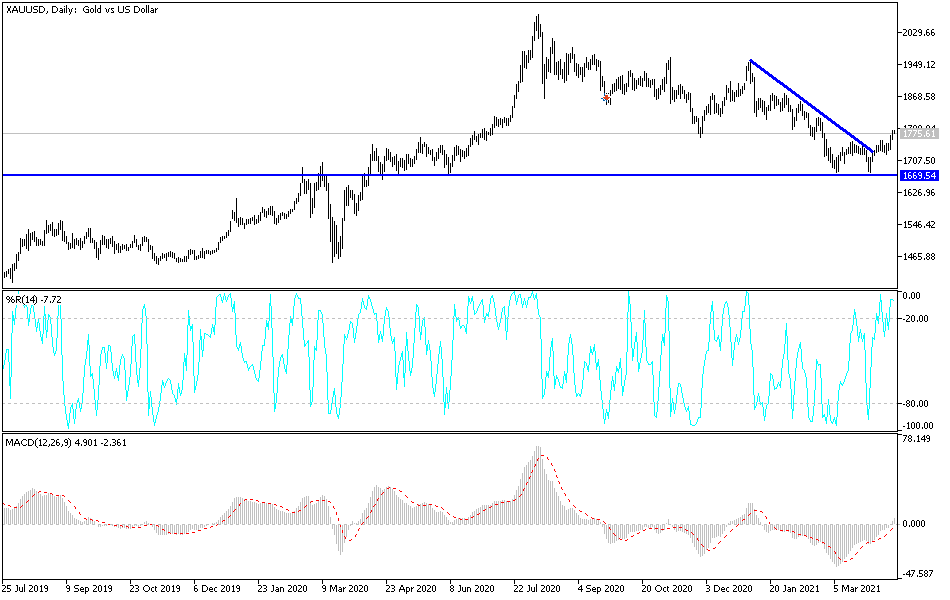

Technical analysis of the price of gold:

In the near term, it appears that the price of gold is trading within the formation of an ascending channel, which indicates significant short-term bullish momentum in market sentiment. Accordingly, the bulls will look to ride the current rally by targeting profits at around $1787 or higher at $1800. On the other hand, the bears will be looking to pounce for potential declines around the support of $1759 or less at $1746.

In the long term, it appears that the price of gold is trading within a descending channel formation, which indicates significant long-term bearish momentum in market sentiment. The recent bounce has pushed gold near overbought levels in the 14-day RSI. Accordingly, the bulls will target long-term gains at around 38.20% and 23.60% Fibonacci at $1838 and $1927, respectively. On the other hand, the bears will be looking to rally at 61.80% and 76.40% Fibonacci at $1696, and from there to the record support of $1609.

The price of gold is not anticipating any important data, and therefore may be affected by the strength of the US dollar, US bond yields, and investor risk appetite.