Attempts to correct the bullish price of gold are still weak despite the decline of the US dollar. This week the price of an ounce of gold did not cross the level of 1750 dollars before stabilizing around the level of 1738 dollars per ounce at the time of writing the analysis. The weakness of the correction attempts to raise the price of gold is due to the high yields of US Treasury bonds. The yellow metal did not have any significant reaction to the latest comments on US monetary policy and economic expectations by US Central Bank Governor Jerome Powell, not even better results of US economic data.

The price of gold retreated after the US Central Bank's "Beige Book" report showed a moderate acceleration in economic growth. At the same time, Bitcoin, one of the biggest competitors for gold as a safe haven, achieved a new record, reaching $ 64,815. The rise in Bitcoin came with the start of Coinbase Global COIN, trading on the Nasdaq Stock Exchange under the symbol “COIN”. The digital platform was given a reference price of $ 250 a share late Tuesday evening.

The US Treasury yields rose yesterday, with the 10-year Treasury yield up 1.5 basis points at 1.64%. Higher bond yields could weaken the luster of gold, which offers no return. However, Naeem Aslam, an analyst at AvaTrade, said that gold is still maintaining bullish momentum as concerns over easing policies from the Fed increase, suggesting a longer period low interest rate regime that would benefit bullion.

At the Economic Club of Washington on Wednesday, Jerome Powell said the Fed would gradually reduce asset purchases before any interest rate increase, but did not provide a date for a change of policy. Prior to that, data showed that US consumer prices rose for the fourth consecutive month, which reinforced the appeal of the yellow metal as a hedge against inflation.

On the economic front, US import prices showed another noticeable increase in March, and according to an official report, import prices rose by 1.2% in March after jumping by 1.3% in February. Economists had expected import prices to rise by 1.0%. The US Labor Department indicated that import prices rose 4.1 percent from December to March, reflecting the largest increase in three months since May 2011.

Commenting on the numbers, Cathy Bostancec, Chief US financial economist at Oxford Economics, said, "Higher commodity prices and strong fundamental effects will continue to boost import prices in the coming months." "However, the acceleration in import inflation should be temporary and tend to decline in the second half of the year," she added.

The report also said that US export prices jumped 2.1 percent in March after jumping by 1.6 percent in February. Export prices are expected to rise by 1.0%. Compared to the same month last year, import prices in March increased 6.9%, reflecting the largest jump since January 2012. March export prices rose 9.1% year-on-year, the largest annual increase since September 2011.

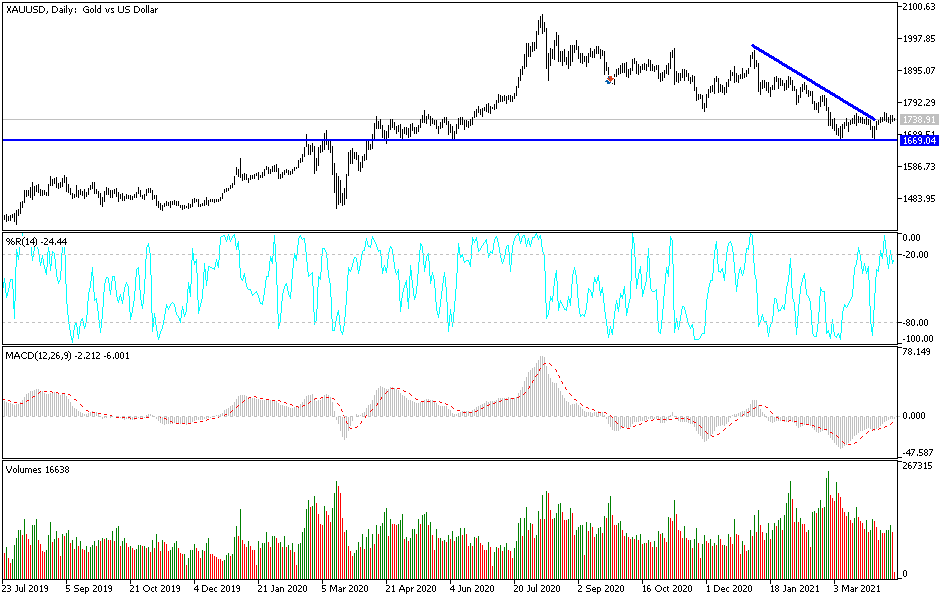

According to the technical analysis of gold: the movement of the gold price in narrow ranges for several trading sessions in a row portends a strong move to come in one direction, and the bears will gain control in the event that the gold price moves to the support levels of 1718, 1700 and 1685 dollars, respectively. In contrast, according to the performance on the daily timeframe graph, there will be no strong and continuous upward breakout without testing the level of psychological resistance of $ 1800. I still prefer to buy gold from every downside.

The price of gold will be affected today by whether investors are taking risks or not, and the US dollar’s reaction to the announcement of the important economic data package, retail sales, the number of US jobless claims for the week, the Philadelphia Industrial Index reading and the US industrial production rate.